Jam invest's anniversary

It has already been more than a year that I released my first substack post. A good moment to look back and hand out some birthday treats!

Table of contents

Word of thanks

Why, what, how?

First year’s highlights

Canada

Biorem

Sintana Energy

Hong Kong

Tianjin Development

HK (sub-)portfolio

Birthday treats » free posts

What’s next

1. Thank you!

I would like to start by saying thank you! It’s been just over a year, and already 1,500 people have subscribed to substack. Thanks so much!

A special thank you to

, , , (fka ), and everybody else who helped to spread the word on Twitter and Substack in the early days, and to , , and for the frequent comments, questions and feedback.2. Why, what, how?

Originally, I started this substack journey just aiming to give back to the #fintwit community. Over the years, I have benefitted enormously from fintwit. The combo of fintwit, TIKR.com and substack even became a decent substitute for Bloomberg. When I benefit from something, usually I also try to give back and support it. I had been tweeting ideas and threads on twitter, and was interested in a format that was a better fit with longer format writing. A format in which it is also easier to include excerpts/tables/graphs/et cetera. Jaminvest.substack was born.

A couple of months into writing the occasional post, I saw a considerable opportunity set of absurd-cheap Hong Kong stocks… and hardly anyone was writing about it. So, I took it up to do that myself and spread the word about the opportunity. The initial response was great, as was the response to the Biorem pitch (see below). Encouraged by that early reponse, I decided to put considerably more time and effort into substack.

Lately, Jam_invest has been a mix of things;

Notes of turning-over-the-rocks exercises

Company write-ups on interesting (up- and coming) quality companies (= Hidden gems) and Absurd-cheap stocks, preferably with high dividend yields

News & insights on the key Jam_invest names

Portfolio (f🔐: founders subscription) and (HK sub-)portfolio monitoring

Financial model templates (f🔐)

…

The topics on Jam_invest will continue to follow the investment areas where I find the best opportunities.

3. First year’s highlights

There have been quite some highlights already this first year. I will just mention the top two topics.

The most explosive stock ideas were without a doubt in …

3.a. Canada

The kickoff in Canada was with a write-up on …

3.a.i Biorem 🏷️

$BRM.v - Biorem is a microcap cleantech company. Its air emissions control systems eliminate odours, volatile organic compounds, and hazardous air pollutants.

The investment case was very simple. Revenues and profits had been depressed because covid-related supply chain issues had delayed project deliveries. Underlying demand had actually continued to develop healthily. As such, I believed it was just a matter of time before profits would surge, exposing a P/E multiple of ≤ 5x.

This thesis materialized beautifully… Actually the share price response - briefly creating a triple - has been even better than I had expected… and I turned more cautious on Biorem too soon.

As the main part of the investment case has played out, I removed the paywall of the first post 👇 on Biorem.

3.a.ii Sintana Energy 🏷️

$SEI.v is an oil & gas exploration company with promising Petroleum Exploration Licenses (PELs) offshore Namibia.

The investment case was also very simple. Sintana looked like a potential multi-bagger to me. At the time of the write-up, it was likely that Sintana’s share price was already covered by the value of its existing oil discoveries. That was indicated by the large oil finds by Sintana’s neighbors (Shell and Total), and by three successful (but still un-quantified) oil discoveries from Sintanta’s partner Galp.

Galp Energia the operator on this license announced the third succesful driling operation on 2024/03/14

Every 1bn barrels of recoverable oil should become worth at least CAD 0.51 per share. The company is potentially sitting on multi-billion barrel oil discoveries in not one license (PEL), but three.

I have written quite a bit about Sintana (mostly paywalled). The posts are easy to find via this tag 👉 🏷️.

Canada has been a very fruitful stock market for me in the past two years. Besides, Biorem and Sintana, there are two other high potential Canadian stocks that I have been covering on substack. Undoubtedly, there will be more of them in the future.

Apart from Canada …

3.b. Hong Kong

Hong Kong was also a very fruitful stock market this year. After more than a decade of hardly paying any attention to it, I finally took another serious glance, starting late 2023. I just could not believe … well… actually I could believe it now, because I had already gone through the “I cannot believe it, it must be fake/fraud phase” more than a decade ago.

So, yes, once again I found a llllloooootttttt of absurd-cheap Hong Kong stocks. The HK 第部分 series just hit episode #30, and I guess I have written about well over 100, perhaps already more than 200 HK stocks this year. The challenge - as always - is to find the better quality ones. In the TLDR section, with ‘Tracking Jam stocks’, and with portfolio posts (f🔐: founders subscription), I try to be as helpful as I can filtering out what I find the best opportunities among the many.

The HK 第部分 series started with this post 👇…

… which laid out;

the opportunity; stocks who’s market cap is substantially to up to multiple times covered by net cash and financial investments - ie Financial Assets Value (FAV)1 - with low valuation multiples, and high dividend yields, and

my selection approach; cherry-picking the profitable companies with decent governance and capital returns to shareholders.

One of the most-bizarre example of an absurd-cheap HK stock is …

3.b.i Tianjin Development 🏷️

Tianjin Development is a Chinese conglomerate with activities ranging from water utilities, and ports to an equity interest in the Chinese operations of elevator company OTIS worldwide.

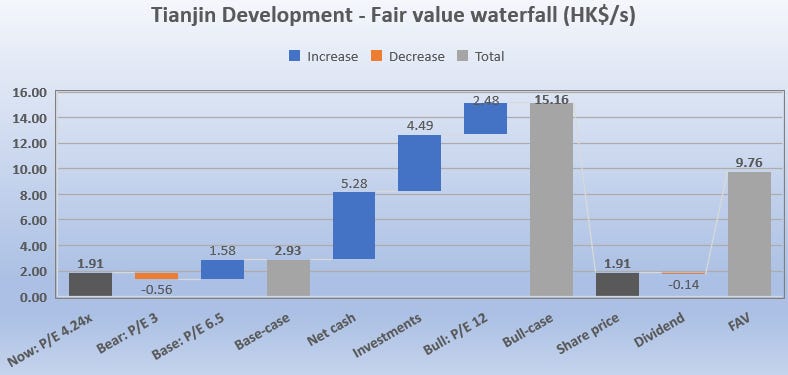

There are many ways to approach the fair value assessment of a stock. The waterfall chart below is just an illustration, looking at earnings and the reported book value of the FAV. I did a more comprehensive valuation analysis in the (paid) post 👇.

The chart starts with the current HKD 1.91 share price, which implies a 4.24x P/E. It subsequently shows how much the fair value decreases or increases with subsequent assumptions.

Applying a 3x bear-case P/E, for instance, decreases the fair value by HKD 0.56, compared to the starting point of a 4.24x P/E.

Incorporating value for the net cash position increases the fair value with HKD 5.28 per share.

All-in-all, the illustration shows that you can get to a bull-case fair value estimate of HKD 15.16 per share, assuming investors will pay 100% for the financial assets AND a 12x P/E multiple. A bull-case fair value of HKD 15.16 vs a share price of only HKD 1.91, I call that a Dollar trading for Pennies. In this particular example, 13 pennies/cents might buy you a 1 HK$.

3.b.ii HK (sub-)portfolio 🏷️

The HK (sub-)portfolio is up over 20% since the start in mid-January this year, including dividends and in local currency. Not bad for an asset class that many investors consider ‘un-investable’. Moreover, the performance calculation is a simple weighted-average. Therefore, every time I add another HK stock - with a return that starts at 0% - that dilutes the ‘portfolio performance’. That obviously understates the real investment return.

Many HK stocks are still trading at absurd-cheap levels AND still offer wonderful dividend yields often in the mid-single-digit to high-single-digit range. That should provide a great set-up for continued solid investment returns in the years ahead.

4. Birthday treats 🏷️

A birthday is not a birthday without some birthday treats. Please do taste the free posts available under this tag 👉 🏷️.

The Hong Kong posts, in particular, are still very, very relevant because the valuations are still so incredibly low. This collab post 👇 is one of my favorites!

5. What’s next?

Investing, for me, is a constant journey to find solid risk/rewards to build the dividend income stream and build/preserve wealth/purchase power… and of course to have some fun and excitement along the way. To a great extent, Mr Market decides where I find the best opportunities and spend most of my time. Putting that into perspective of the Stock Market Cycle (graph 👇 from MarketWatch), in the most recent two years or so, I have been mostly avoiding Western large-cap stocks, and mostly moving towards microcaps and emerging markets companies. Many emerging markets and HK 第部分, in particular, have been looking like they’re around the “Point of Maximum Financial Opportunity”. So that’s where I have spend the predominant part of my time and energy.

The content on this substack will continue to follow the areas where I believe I find solid risk/rewards and where I feel I can add value by writing about them. Mostly, I am focused on companies that to a great extent can define their own fate, as opposed to being heavily dependent on the the external environment (commodity prices, interest rates, regulations, et cetera). As a result, I tend to gravitate towards consumer, software, and healthcare-type businesses.

Disclaimer

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Footnotes

Financial Assets Value (FAV)

Definition: Cash and cash equivalents + Investment securities + Investments in Associates + Investment property -/- Borrowings and Contract liabilities

Congrats and great content!

Happy anniversary Jam - and congrats on the picks!