Hidden gems; Biorem

CleanTech company Biorem won strong order bookings in the past 2 years. Profits should surge, and the P/E should drop to ≤5x when it delivers those orders.

Biorem is a provider of air emissions control systems to eliminate odours, volatile organic compounds, and hazardous air pollutants. Biorem solutions reduce cost; increase energy efficiency, and improve the quality of lives for communities.

Depressed profitability despite strong order flow

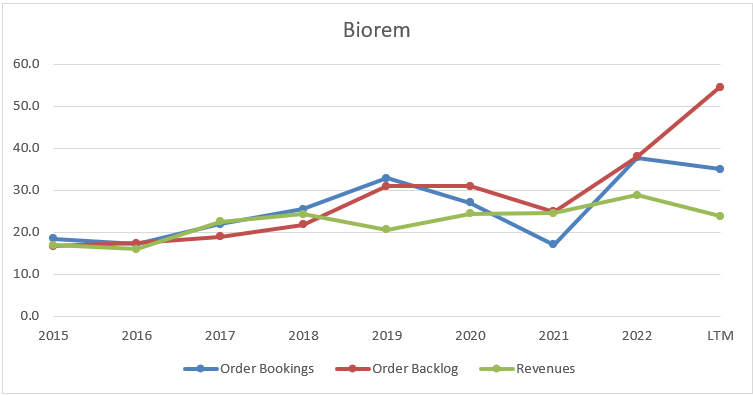

Biorem ($BRM.v) 🏷️ has had a very strong organic development, looking at Order Bookings and the Order Backlog (…a bit like Pro-Dex $PDEX.us). In the first half of 2023, it had particular success gaining orders for air emissions abatement projects in North American municipal wastewater treatment facilities. Despite the strong order flow, 12 month trailing revenues are down 28%, and profitability is down substantially more. The revenue declines between Q1 and Q3 of 2023 were caused by continuing delays in customer project construction schedules in North America, due to material and labour shortages.

Normally, the majority of the Order Backlog translates into revenues in about 12 months. In the period 2015 until 2019, the backlog-to-revenue conversion ranged between 95% and 129%. More recently, however, the conversion has been considerably lower.

Backlog & management suggest upswing

Management’s current estimate is that approximately 75% of the Backlog - of CAD 54.5m as of September 30th, 2023 - will be converted into revenue during the next twelve months. That implies CAD 40.9m revenue in the next 12 months, up a whopping 71% from trailing 12 month revenue of just CAD 23.9m.

Management commentary from the 2023Q3 results filings:

Due to customer scheduling, the Company cannot provide precise guidance as to the quarters when the Backlog will be converted into revenue however management’s current estimate is that approximately seventy five percent of the Backlog will be converted into revenue during the next twelve months.

“Our sales funnel, opportunities, bookings and backlog remain at historic highs with no signs of softening over the near- to medium-term.”

“Unique in the Industry, BIOREM’s broadening of the revenue base through product expansion and diversification, have resulted in significant achievements over the last several quarters. This investment in new products and sales initiatives has generated more than two dozen projects and approximately $25 million in bookings outside of our traditional sales base. This is a reflection of a strong market demand for BIOREM’s experience and performance in delivering successful air emission abatement projects.”

“In addition to developing new sales initiatives, we’ve devoted considerable attention to increasing the resilience and diversity of our supply chains to ensure that we can mitigate the impacts of inflationary pressures and ongoing logistics disruptions and delays. The results from these efforts have been dramatic and are reflected in our on-time delivery for projects and increasing profit margins.”

Profits to increase much faster than revenue

Profits changed much faster than revenues on the way down, and so should they when revenues turn back up. A lot of that will be driven by revenues simply growing faster than the fixed cost base. These relatively fixed costs likely accounted for roughly 30% of total operating costs in the past 12 months.

At the May 2023 Rivemont MicroCap Cocktail Event - around the 19 minutes mark of the presentation - CEO Derek Webb explained the plan to double profitability of the company in the next 3 years.

“In the next 3 years we are looking to double the profitability of the compay, but at the same time having cost parity. …with inflationary pressures, trying to maintain our cost base as it was several years ago as we move into the future, is going to prove a big challenge. But it’s one that we think we are up to the task.”

Below, I outline profitability scenarios upon delivery of the order backlog. As you can see, delivering 75% of the order backlog in 12 months can lead to over CAD 0.20 in EPS. That implies 5x P/E, at the current share price of CAD 1.07 share price, and potentially even a lot less than that.

Key Risks & Attractions

Some of the key risks include:

All the obvious risks regarding microcaps, one of them being liquidity of the share. At lower share prices, liquidity just tends to dry up, as fewer and fewer shareholders are willing to sell. More recently, trading volumes have started to improve along with the share price.

Revenue tends to be lumpy because Biorem is dependent on customer delivery schedules. This also creates strong seasonality to the business, with Q1 revenues typically marking the low-point in the year.

Project cost over-runs; the backlog tends to have fixed prices. Biorem typically cannot raise the pricing after the order is awarded. In early 2023, the company was able to keep cost variances below 1-2%, despite 10% producer price inflation. Although the past track record has been impressive, that is of course no guarantuee for the future.

Quite frankly, Biorem would normally be a type of stock I would try to avoid by miles. Project-based / capital equipment sales companies tend to be inherently unpredictable. In this particular case, I think there are a number of attractions that are worth the exception.

Timing looks good; Revenues are currently depressed. They hit their trough in 2023Q1, and have been slowly recovering sequentially in Q2 and Q3. Q4 tends to be the strongest revenue quarter, seasonally. Management has guided for a strong Q4 in terms of revenues and earnings. Moreover, the strong order backlog can support strong revenue growth for at least a year.

The valuation looks very attractive, if the backlog indeed gets delivered as expected, and new orders continue at solid levels.

The revenue should become more predictable over time with the focus on recurring revenues. A few years ago recurring revenues contributed about CAD 150-300k per year. Last year that hit a peak of CAD 5m, 17% mix. Moreover, 400-500 out of the 1800 installations to-date are ageing and going to require an estimated CAD 60-70m in service/maintenance work.

Biorem is a hidden champion in terms of free cash flow (FCF) generation and particularly on the Return on Invested Capital (ROIC). Although the profit margins have not been that high, historically, ROICs have been well over the 30%. The business simply does not require that much (capital) investment. Consequently, every dollar invested can generate strong returns for shareholders.

Increasing environmental regulations should remain a growth driver for many years to come.

Excellent stewards of capital; The management team has been running the company mostly in a profitable manner, being frugal about spending money. It has also proven the ability to opportunistically seize value creative opportunities, as it did by buying out the largest shareholder and retiring 60% of the shares outstanding! The next catalyst in this regard, will likely come in the shape of an acquisition, which should be “value-accretive right out of the gate”.

How to learn more?

CEO Derek Webb’s presentation at the Rivemont MicroCap Cocktail Event is an excellent way to start learning more about the business, as is Paul Andreola’s interview in the investor relations section of Biorem’s website, and on Youtube. In 2016, Paul Andreola and SmallCap Discoveries originally pitched Biorem in the “Cheapies with a Chance” list.

Great article! How would you describe their most?