1. Intro

Random thoughts on (2.) portfolio positioning and on (3.) some U.S. Jam stocks.

2. Portfolio positioning

2.a Bull market

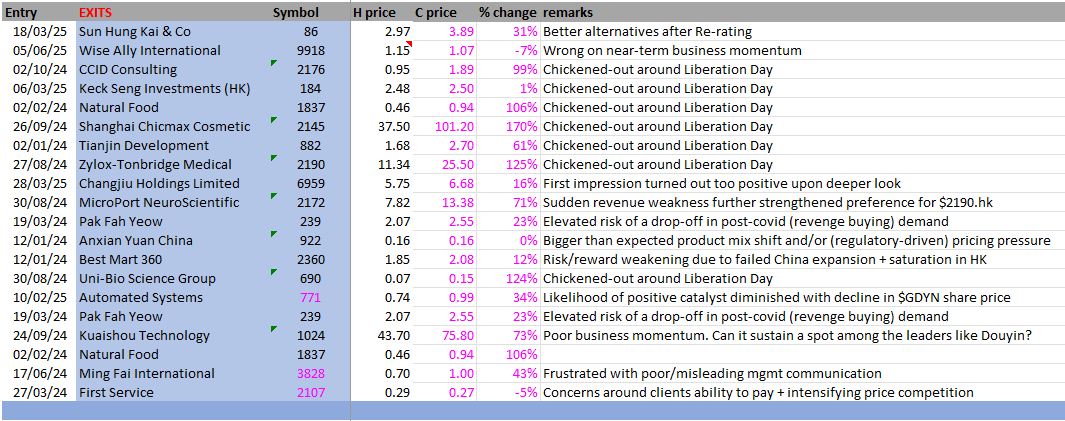

You (that is me) know when you’re (still me) in a bull-market when even the Hong Kong stocks you (still me) exited perform like this…

DISCLAIMER!! These are HK stocks I exited. So comparing the C(urrent share) price with my H(istoric) price serves no other purpose than just exemplying that the Hong Kong stock market has been in a bull-market in the past two years. Believe me, if it was not, then the picture would have looked very, very different.

N.B. the dividend yield on my average purchase has been in the 6 - 8% range. Almost all these stocks are dividend payers. Those divies naturally come on top of any share price performance.

Obviously, Hong Kong is not the only market that has been in a bull-market. The same can be said for US (mega-cap) tech, which I have skilfully managed to avoid. 😬😳

I bet I would be a very bad Pokemon player 😬😳 …

… just too dumb and/or too stubborn and/or too focused on what I think is my ‘circle of competence’… The latter sounds the best of cuz.

Where were we? O yeah… a bull-market in HK stocks, US (mega-cap) tech stocks, Financials (at least the Kazakh, Georgian, Colombian and European ones I have on my monitor), and a bunch of other categories I try to ignore…

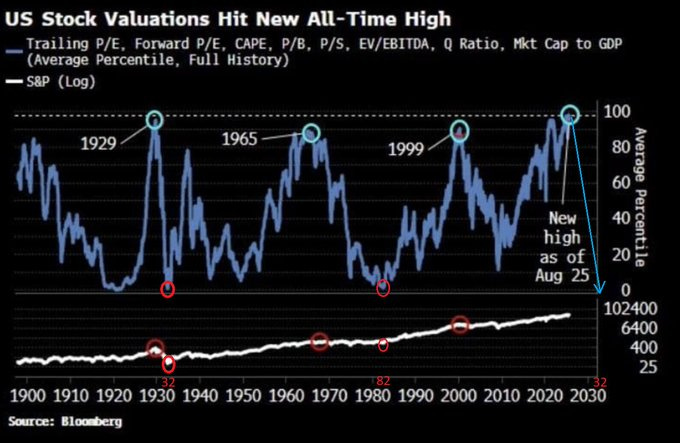

… like gold and cryptos. With bull-markets, it is great while it lasts, and it obviously sucks bigtime when they blow up, cuz…

… when they inevitably do. You (that is also me) undoubtedly will lose a lot of dough, very quickly…

Compliments to JDB_trading for the chart! The guy comes up with the wildest chart scenarios, … that materialize in a surprisingly (to me) high frequency. So, we’ll see if this bull-market scenario for the Nasdaq materializes, or whether the bull-run continues for a while longer. In any case, I keep on having in the back of my mind that things can get very ugly very quickly… I can tell from my prior experiences;

Asia crisis 2018

Dotcom bubble implosion post Y2K… for the younguns » after the year 2000

Great Financial Crisis 2008-2009… which really already started with groups of cyclical stocks starting to decline around 2006-2007… come to think of it… it is interesting that the staffers which started te decline early-on last time around are now also going through a rough patch » see footnote 1.

2.b. Positioning

Personally, I am pretty bad at ‘flow investing’. Heck! Late 2023 - early 2024, I had no idea that my timing in HK would be as fortunate as it was… as it was in Kazakhstan, Georgia, and some other buckets. All I am interested in, is just picking up favorable looking risk/rewards, generating a solid (dividend) income stream, having some fun, preserving/creating a bit of wealth, etc. etc.

I try to be mindful of ‘flows’, and at least not go too heavily against them. And also not to chase the trains that have already left the station, at least not too aggressively. Quite frankly, I’m often dumbfounded of the enormous re-ratings and de-ratings from Mr. Market. Why did the Georgian banks re-rate from roughly 4x P/E to roughly 7x P/E in a bit over a year, for instance? Why does nobody love my oil stocks anymore… nor some of ‘my’ companies that have hit some headwinds and execution issues?

Also, a surprisingly large number of prior-darling, western, large-cap staples and healthcare have come off considerably; Avantor, Brown-Forman, Baxter, Estee Lauder, etc etc… and still many of them do not look cheap, especially when considering how indebted many are.

Q: » Positioning, Jam! You were going to talk about positioning!

Aahhh, indeed! Yes, on positioning. With the kind of bull-runs that we have seen in various categories I find it harder to still add aggressively in those buckets. I can hardly call valuations in some of my favorite Emerging Market names, like First Pacific, Halyk Bank demanding… but I also need to acknowledge that the same sudden (in)flows that moved these stocks higher, may very well chase the next hot thing next week. Who knows? Moreover, I try to not get overboard with the concentration in particular industries and countries » particularly the ones with which ‘our’ devine leaders / policy makers are constantly…

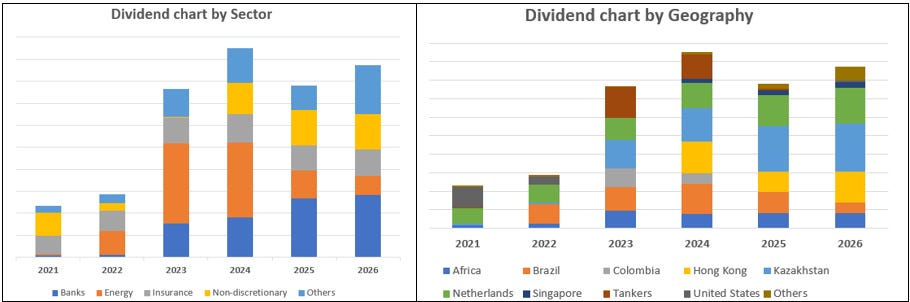

Lately, I have been moving towards some new (for me), mostly ‘unsexy’ / out-of-favor areas, predominantly still stocks with high emerging markets exposure, strong balance sheets and strong divies, but now skewing more towards Southeast Asian countries, either directly in small/microcaps in Malaysia... (you get a bit of a flavor in the post below)…

..., or through some U.S. stocks/ADRs. Now, obviously there is a reason that these stocks are out-of-favor… and I may be totally wrong going against the grain on them. So, likely I will just gradually build up positions and write more about them as I go along. As always, you can find my portfolio in the Founders’ section. (f🔐)

NB, 2025 and 2026 figures are (mostly) my estimates based on my current portfolio

3. Updated thoughts U.S. Jam stocks

Below, some updated thoughts on Kaspi, Open Lending and Research Solutions… and a link to the update from ClearPoint Neuro’s biggest shareholder 2.

3.a ClearPoint Neuro 🏷️

Ticker: CLPT.us

Share price: USD 11.20

I’ll leave it up to Michael Bigger to do the update on this one. This long-time shareholder provided updated throughts » on 2025/09/10.

3.b Kaspi 🏷️

Ticker: KSPI.us

Share price: USD 88.00

Is Kaspi interesting again, guys and girls?

I find it rather intriguing how the stock has de-rated since the initial honeymoon phase following the US-listing, early 2024. Especially, since we have seen quite the opposite moves, considerable re-ratings, for its Kazakh and Georgian peers, and…

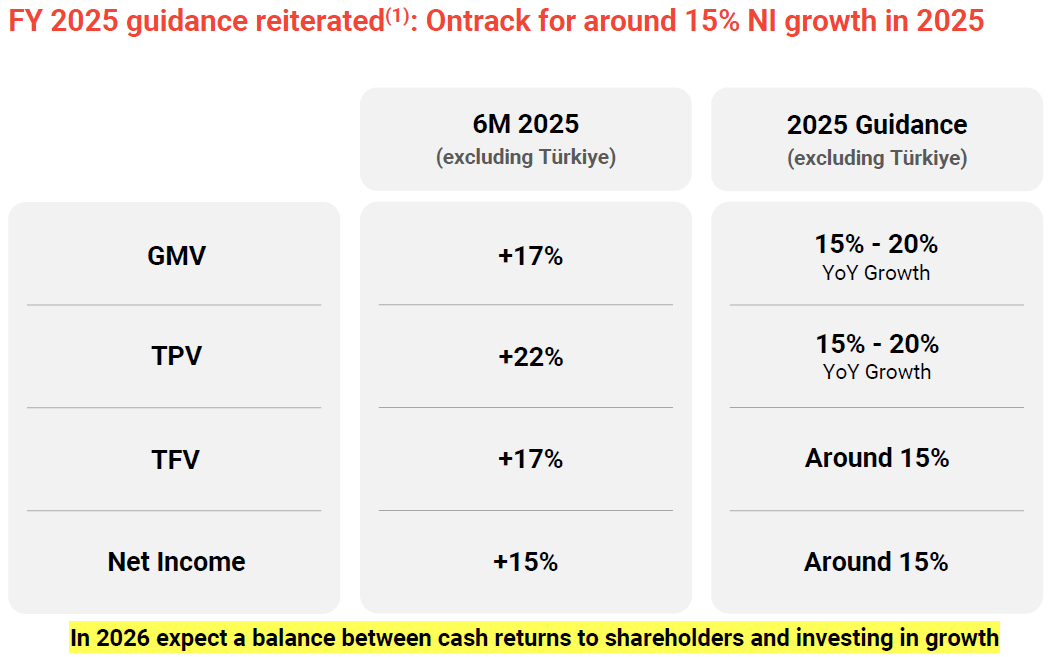

… 2026 is fast approaching, for which management guides to a return in cash returns to shareholders. Now, I don’t think it immediately will, because of likely growth investments, but if it does return to the prior quarterly dividend rate of KZT 850 per share… Then we’re looking at a potential USD 6.29 annual dividend per share and a 7% divi yield. Not quite like Halyk Bank, but tell me where you find another growing (fin)tech-platform with those levels of potential cash returns?

3.c Open Lending 🏷️

Ticker: LPRO.us

Share price: USD 2.25

2025/04/01 - First write-up…

It’s definitely not my hobby to try and catch falling knives. And yet, I felt I needed to with the car loans underwiting platform, when its stock got destroyed (once again) on April 1st.

There are a lot of lending-related businesses. The uniqueness about LPRO is that it helps lenders (mostly credit unions) to underwrite car loans with an insurance wrapper. That credit insurance…

enables credit unions to extend car loans to

sub/near-prime borrowers,enables borrowers to get a loan at very competitive interest rates,

offers a diversified (insurance premium) income stream to insurers, and

typically generates a 3-4% fee on the size of the car loan, to LPRO.

You can read my series of posts on it in the Odd lots section on the website. So, I won’t rehash everything.

My main two reflections since the initial post are…

I was astonished that the March 31st reported Q4 release caused such a watershed investor exodus. The stock was already bombed out on March 31st at USD 2.76, or so I thought. I wrote my April 1st post when it crashed to around USD 1.60-1.70 during the day. It ended the day at USD 1.17, and subsequently continued to decline to as low as USD 0.70... giving it a negative(!!) enterprise value by that time. 🥴🤢🤮 Never underestimate how investors will jump on the opportunity to throw the baby out with the bathwater!

The main business development since then is basically that the new management has taken more drastic measures, than I expected, to reduce credit risk for its lender and insurance partners, and to make the business much more conservatively, more tech-savvy, and more cost-efficient. These are the near-term focus points, before management shifts the business towards a growth focus late 2025, early 2026.

The main consequences »

more revenue and profit pressure in the short-term,

much lower (tail) risk of losing lending and insurance partners, and

higher profit-margins when the cost efficiencies (and revenue growth) kick(s) in.

On the last point, I am intrigued by this commentary from the last earnings call ….

Our goal heading into 2026 will be to pursue growth and maintain a cost structure supported by program fees and TPA (= Third-Party Administrator) fees alone.

This means we are achieving profitability based on the profit share component of unit economics.In the near term, we will continue to focus on cert quality, and we are hopeful that once we have our new processes in place, this will eventually allow us to increase the quantity of certs while mitigating the risk of another large CIE event.With that in mind, I wanted to specifically call out that while our operating expenses were up this quarter, this was partially due to onetime severance charges. We've completed the work to identify substantial run rate savings for 2026 and plan to have implemented all planned actions by year-end. This includes secondary RIF that was completed on July 13 and changes to our commission structure. We are also examining potential efficiencies to be gained by utilizing machine learning and scalability, which we believe have the potential to boost productivity and increase the accuracy of our claims review.

I do want to be clear that we will continue to invest in targeted areas, including our data science space. As I mentioned earlier, we are planning to transition into an expense structure that is supported by our program and TPA fees on a run rate basis by the end of 2026.

NB, I struck through one sentence that I believe was a mistake from Chairman/CEO Jessica Buss. I have tried to reach out to the company about this… but no response (thusfar)… hopefully that is a sign the people over there are working their butts off to restore the business to its former glory. 😉

Jessica’s commentary around the expense structure relates to the run-rate by the end of 2026. Therefore, understanding what costbase Jessica has in mind, requires knowing what level of Program and TPA fees she expects by that time. Now, I do not have a crystal ball. So, I’ll just check what the commentary would imply on the mid-point of “certs” (= car loans volume or certified loans facilitated) guidance for 2025Q3.