News & Insights #24

China from "Un-investable" to "Buy EVERYTHING" *** Four portfolio additions *** A roll-up story for 6x earnings *** Kazakhstan fights back against short-seller **** HK investing strategy *** And more

Intro

It was an eventful week, with lots of news and excitement. In the midst of that, I introduced four new HK growth stock additions for the HK (sub-)portfolio, 👉 here and👉 here. That will soon be followed-up with more details on the two MedTech names.

On average the four growth stocks hold roughly one-third of their market cap in net financial assets value (mostly cash), and trade at low- to high-teens estimated earnings for 2025. All four companies have been increasing capital returns to shareholders. Three of these stocks still trade very close to multi-year lows. Their market caps range from about USD 500m to well over USD 10bn.

Besides the usual News & Insights, this edition includes my updated thoughts on my investment strategy for the HK (sub-)portfolio.

Coming up soon

HK MedTech stocks

My investment approach for healthcare stocks

Write-up on cheap largecap stocks of a dominant LatAm staples co, trading with a hsd % divi yield

And more…

Poll

Links, references & more

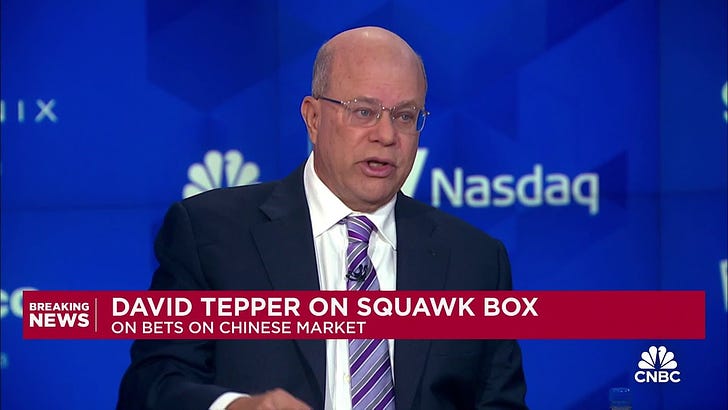

The David Tepper interview - “Buy everything in China” - broke Twitter this week. A must-watch!

I guess he is a jaminvest subscriber. 😉 What’s your substack handle, David? 😉😉

AngelAlign $6699.hk;

pitches this dominant Chinese dental company, 👉 here.Diageo $DGE.L needs more challenges 😉

MINISO released an announcement stating that it will acquire a 29.4% stake in Yonghui Superstores for approximately 6.3 billion yuan ($892.1 million). More about that, 👉 here.

Nongfu Spring $9633.hk;

describes the recent challenges, here, while competitor China Resources Beverage - C’estbon brand - is seeking a HK listing.Samyang Foods $003230.ks; The Buldak ramen noodle brand has been on fire (pun intended) in the US in recent years. Read and listen about it in this 👉 post ($) by

.