News & Insights #11

Broadening broker stock purchase restrictions *** Eugèn Riche is a hit in France *** Are Boards finally recognising absurd-cheap values of HK stocks? >> Asia Cement take-over bid suggests it

Broker stock purchase restrictions

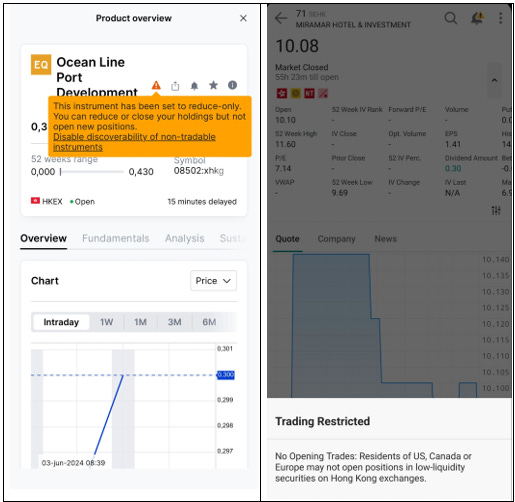

Interactive Brokers followed Saxo in broadening the number of stocks that cannot be bought anymore. In one of my high school class-rooms there was a poster telling the history lesson what happens when you start ostracizing groups. Spoiler alerts; it usually ends badly. Anyways, after severely reducing what US OTC stocks one can buy, HK stocks (mostly < USD 50m market cap) have now become the second shoe to drop. Let’s see what group will be next.

Personally, I have sought professional help to properly express my feelings to Interactive Brokers and Saxo, and any other broker or regulator that seeks to restrict stock transactions, especially those in sound enterprises...

Buy-order restrictions » Left: Saxo Bank, Right: Interactive Brokers

FYI: Miramar $71.hk is a HKD 7bn market cap company. It is not very small. Moreover, the ever increasing restrictions do not just include Hong Kong stocks.

On Twitter, and I addressed the issue, hoping to ignite some protest… but not that many people seem to care. From 6,300 views, only 108 people bothered to vote that “It’s an outrage!” C’est la vie.

If you do care, and want to continue having flexibility in what stocks you can buy, then it is probably time to diversify your broker relationship, if you have not already done so.

Obviously, I will continue to invest in HK/China.

The absurd-cheap valuations are just too good to turn down. There are obvious reasons why some sort of valuation discount for HK stocks is warranted…. but current discounts are still WAY WAY too juicy in many cases, imo.

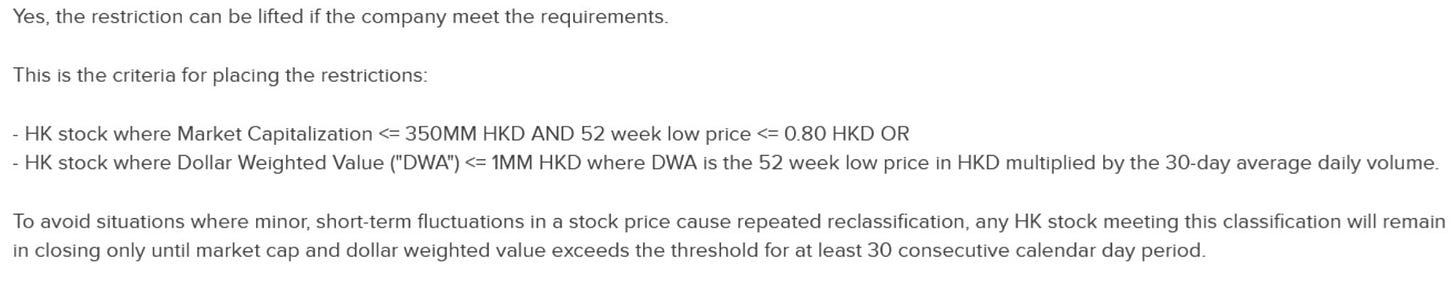

ADDENDUM 2024/06/07 - IBKR restrictions

France A-Z

In a quest to find more Hidden gems, I started an A-Z screen in France. (Very few stocks are on the restricted lists over there.) This week I posted the first results. Learning about Eugèn Riche 1, in particular, was a phenomenal discovery. Thanks @gezzogero / for helping me with her, and for the other valuable insights. Also special thanks to for demonstrating his local and very extensive knowledge of the French stock market.

In the same post, I also laid out what some of my favorite characteristics are for Hidden Jams.

Founders

Thusfar, the Founders section contains the following content;

The most-recent Portfolio, with again increased disclosures

Index; This is a useful evergreen guide to navigate to key posts and companies on this substack

Financial analyses; the first models are up and running. To-date, there are spreadsheets on Yum China, DPC Dash (Domino’s China), and the Namibian oil assets for Africa Oil and Sintana Energy.

On 2024/04/21, I published an Exclusive stock idea for Founders, on a European microcap (MCC). This week I opened up the post for all paying subscribers. For stock liquidity reasons, I chose a staggered approach to release the idea. Rumor has it that this stock is going to get its first sell-side research coverage this month. That could become a nice catalyst.