HK 第33部分; One Day Stocks #2 (f🔐)

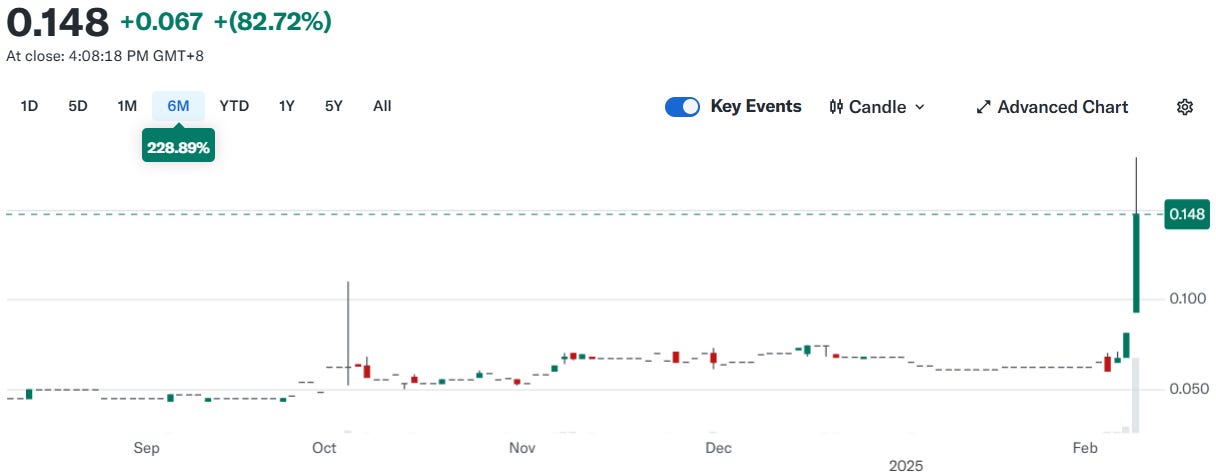

Some stocks gradually compound away, year after year. Others return years of performance in a brief period of time... Mexan just did 82%(!!) in one day. There are lots of others with such potential.

The 82%(!!) one-day return on Mexan Limited $22.hk demonstrates that is fishing in the right pond. And the bright side is » There are still lots of other appetizing fish, like Mexan, that have not played out yet. To make that point even more clear, I am posting another couple of ideas in this post… with more to come later on.

NOT INTERESTED IN HONG KONG STOCKS?

Just turn off notifications here: https://jaminvest.substack.com/account

As so often, I will likely do brief overviews of potentially interesting stocks, first… and then I will gradually start diving deeper into the best-looking ones, later.

Given, often limited, stock liquidity, I have been limiting access to these type of stock ideas by effectively suspending new monthly paid subscriptions, and phasing the release of more ideas than usual; releasing them on the Founders’ tier first, or exclusively.

Table of contents

Everbright Grand China Assets; property investment and management services at 18 cents on the HK$

Earlier-mentioned stocks

XXXXX; real estate and equity investments at 12 cents on the HK$

Jaminvest resources

Disclaimer

Footnotes

1. Everbright Grand China Assets

Mr. Market seems to be warming up to absurd-cheap Hong Kong stocks. Just look at Everbright Grand China Assets $3699.hk for instance…

…up 45% just on 2025/02/10 on 89x the average traded volume.

Ticker: $3699.hk

Description: property investment and management services

Share price: HKD 0.51, as of 2025/02/10

Dividend: HKD 0.0184 p/s (HKD 0.0078 interim 2024H1 vs HKD 0.0106 interim 2023H1, HKD 0.0066 final for 2023)

Broker availability: Interactive Brokers (incl residents

Canada/Europe/US),Saxo

Situation

HKD 225m Market cap

HKD 1,264m or RMB 1,185m FAV1, as of 2024/06/30 » P/FAV 0.18

RMB 962m Investment properties

RMB 223m Net cash

Peculiarities

Broker availability is an issue on this one. So, I did not spend much time on it.

Value assessment on the investment properties raises questions. I see an annualized HKD 32m in gross rental income from investment properties. The implied gross rental yield of just over 3% seems a bit richly valued to me… possible, but something to look into… probably not that it matters too much, with the Net cash already covering the whole market cap.

2. Earlier-mentioned stocks

For Free subscribers; some earlier-mentioned freebies…

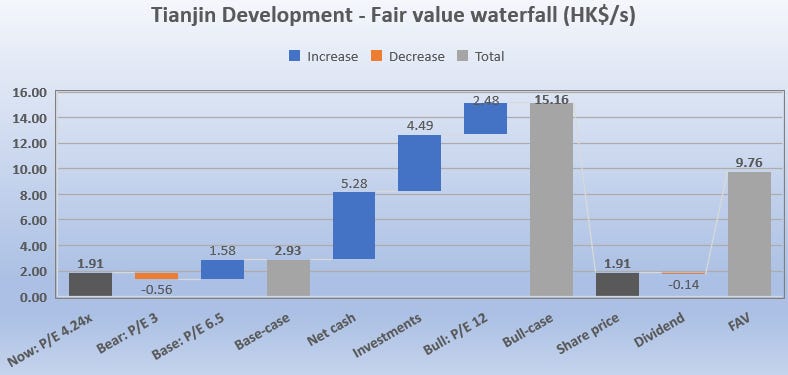

Tianjin Development $882.hk has been one of my earliest Hong Kong Dollar trading for Pennies… and is still a favorite… my first post mentioning it…

A cool fair value waterfall chart…

China Dongxiang $3818.hk is a HKD 0.35 stock with a roughly HKD 1.70 cash + equity investment portfolio. A nice levered play on a potential new bull-market in Greater China equities.