HK 第28部分; MedTech stocks

On 2024/09/24 and 2024/09/26, I introduced four high-growth Hong Kong stocks. This post is a follow-up on the two MedTech names.

U.S. trade war beneficiaries

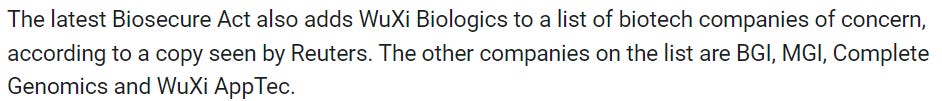

The U.S. continues to intensify (trade) tensions with China. On 2024/09/23, for instance, the U.S. Commerce Department announced plans to ban the import or sale of cars with specific hardware or software linked to China or Russia. Earlier this year, Congress aimed to restrict Chinese biotech companies from accessing the U.S. market.

On 2024/09/25, China’s Ministery of Commerce announced a probe into PVH Group. Is this (another) sign that the Chinese government is going to take countermeasures?

I believe Chinese MedTech companies have a lot to gain if these trade tensions reach a climax. In 2019, American companies held over 90% market share in the Chinese markets for neuro-interventional1 and peripheral artery interventional2 devices. Medtronic alone held 60%+ share in neuro-interventional devices. While those percentages have dropped in the past few years, American companies still hold considerable share. I regard the domestic players as the most likely candidates to pick up those revenues in case the American players lose access to the Chinese market. Vice versa, the Chinese players have (yet) little to lose in the U.S. Although longer-term, the U.S. could also push to limit the access of Chinese medtech companies to other international markets.

While an intensifying trade war with the U.S. could accelerate growth in the short-term, the medium-term growth outlook for several Chinese MedTech companies looks solid either way…

Let’s have a closer look at two of them!

HK MedTech stocks

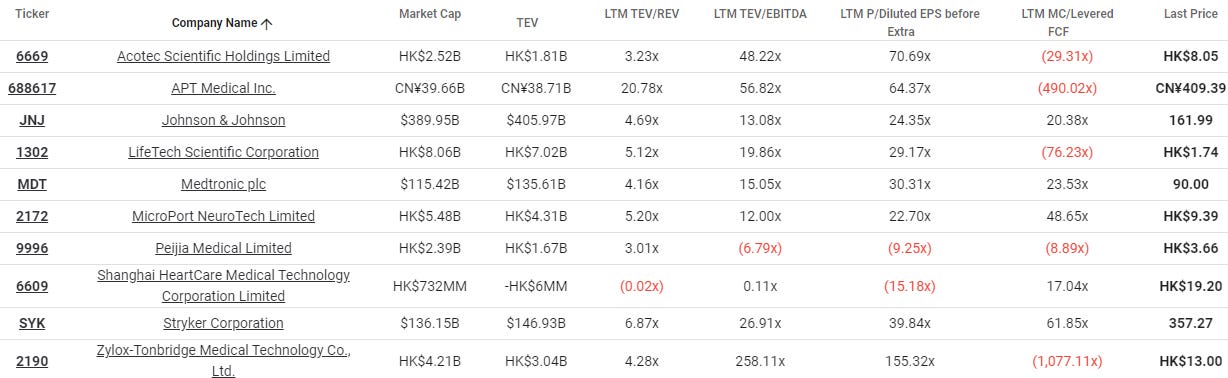

Below you see the four Hong Kong growth stocks I introduced on 2024/09/24 and 2024/09/26. In this post I do a follow-up on the two MedTech names from the former post;

MicroPort NeuroScientific and

Zylox-Tonbridge.

NB, be careful out there. Stock prices on the HKEX have been rather volatile lately.

Valuation tables

2024/09/24

2024/09/26

2024/10/07

Definitions:

FAV/s: financial assets value (FAV) per share. FAV consists of cash, investment securities, investment properties, investments in associates/joint ventures, minus borrowings.

Price: share price

FAV/P: FAV per share as a % of the share price.

P/E: price-earnings multiple

DY: dividend yield

MC: market capitalization in millions in the share price currency (HKD in these cases)

NB. stats are strictly my assumptions. I may be terribly wrong.

NB, Chinese companies are regularly known under various different (English translated) names.

MicroPort NeuroScientific or 微創腦科學有限公司 is also know as MicroPort Brain Sciences and Minimally Invasive Brain Sciences, and recently changed its official English name from MicroPort NeuroTech.

Zylox-Tonbridge or 歸創通橋醫療科技股份有限公司 is also known as Gui Chuang Tongqiao-B

Growth drivers

Aging population; The number of neuro-interventional procedures in China increased from approximately 46,200 in 2015 to 161,400 in 2020 at a CAGR of 28.4% and is estimated to further increase to approximately 740,500 in 2026, at a CAGR of 28.9% from 2020 to 2026. There are three main drivers for that. First of all, an aging population. Older people are more at risk of blocked or narrow arteries, which can for instance lead to strokes, and is a leading cause of death.

Number of neuro-interventional procedures by type of disease

Source: China Insights Consultancy

Rising penetration; Secondly, the penetration of interventional surgery started from a very low base in China. While interventional treatment has been rising rapidly, it is still a just a fraction of the penetration rates in the United States. In 2020, for instance, the penetration rate of neurointerventional surgery for intracranial aneurysms was only 9% in China versus 62% in the United States. In other areas, the penetration rates in China were even much lower.

Since 2016, national policies have supported the strong growth in interventional surgery through awareness campaigns, the construction of a nationwide network of specialized stroke treatment centers (over 2,030 already in mid-August 2024), et cetera. A continued flow of medical device introductions also helps increase the penetration of interventional surgery. Finally, an overhaul in the healthcare regulations (see below) led to big drops in prices, which made many healthcare treatments more affordable.

Market share gains; Helped by supportive government policies - such as priority marketing approval for medical devices, and preferential medical insurance reimbursement on domestic vs imported devices - domestic players have been rapidly expanding their product portfolios (see the product schedule for MicroPort NeuroScientific » footnote3 and Zylox-Tonbridge » footnote4). Domestic neurointerventional medical devices are generally more cost-effective and have a richer range of models to meet the needs of domestic doctors. Consequently, domestic products have been substituting imported medical devices from the big (U.S.) multinationals. In 2023, in some provinces domestic players have already gained a quarter of the overall market in the aggregate, up from less than 10% share in 2019.

Some areas of particular strength for Zyox-Tonbridge include 20-25% share for the "Silver Snake" intracranial support catheter (Ischemic stroke), and c20% share with the "Baiju" intracranial PTA balloon dilatation catheter (Stenosis). MicroPort has a dominant position in cerebral atherosclerotic stenosis with “market shares of the Group’s APOLLO™ Intracranial Stent ranked the first (approximately 60%) and the market share of Bridge® Vertebral Artery DES ranked the second (approximately 50%) in China in terms of the implantation volume in 2023.”

Nevertheless, U.S. companies still dominate the overall Chinese market. Medtronic leads in neurointervention, followed at a big distance by Johnson & Johnson and Stryker. In peripheral artery disease (PAD) interventional surgical devices, leading players are Cordis, Boston Scientific, Senrad, CardioVac, and Medtronic.

Interestingly, in 2015 the government announced the Made in China 2025 (MIC2025) initiative. Among other targets, MIC2025 calls for 70% of mid-to-high-end medical devices to be produced domestically by 2025, and for this to rise to 95% by 2030… Hurry-up, MicroPort and Zylox! While these targets are unlikely to be reached - especially the 2025 one - it does indicate a strong direction in favor of domestic favorites.

Pricing (regulation); The Chinese government has succeeded in driving huge price declines (often from previously inflated prices) in the healthcare sector through centralized volume-based procurement (VBP) policies5 for public hospitals.

VBP was started in the drugs category, and later expanded to medical devices. The kick-off in the medical device industry was in November 2020 with coronary stents. Companies could bid in a public tender for over 1 million coronary stents, equal to nearly 70% of the consumed total in 2019. Eventually, eight companies won the bidding, including two American companies (Boston Scientific and Medtronic) and six Chinese companies. The average winning price meant a 90%(!) drop versus prior market prices. That offers another reason for the share price weakness (understatement) that Chinese medtech stocks have endured in the past few years. Soon after the coronary stents program, similar VBP programs followed for vascular interventions, orthopedic implants and ophthalmic materials. In these categories, average prices initially dropped by roughly 60%.

Several of the domestic players have faired very well in the new system. They have been the big beneficiaries of volume expansion. While there has been gross margin pressure from the price declines. This has been mitigated by efficiency gains, operating leverage, new product introductions, et cetera.

MicroPort NeuroSciences - P&L snapshot (by TIKR.com)

Zylox-Tonbridge - P&L snapshot (by TIKR.com)

MicroPort on VBP regulations;

As of the end of the Reporting Period (2024H1), most provinces across the country have implemented the post-VBP price of coils. In addition, in the first half of 2024, the Hebei “3+N” provincial alliance conducted the VBP of 28 types of consumables, including products in the field of neuro-intervention such as guide catheters, thrombectomy devices and intracranial stents. The VBP policies will become a turning point for China’s neuro-interventional industry through exchanging price for volume and survival of the fittest, promoting the transformation of enterprises from “marketing-driven” to “cost-driven” and “R&D-driven” for the pursuit of the high-quality and standardized development of the industry.

Zylox-Tonbridge VBP development

International expansion; It is still very early days in the international expansion, with a revenue mix of 6.9% for MicroPort NeuroScientific and just 3.1% for Zylox-Tonbridge. Nevertheless with 87% and 84% revenue growth, respectively, in 2024H1, it is already a meaningful growth driver. MicroPort has commercialized 8 products in 21 countries, Zylox over 10 products in 22 countries.

MicroPort’s strategy has been to penetrate the largest countries by volume of neuro-interventional procedures first, and then to gradually enter the countries and regions ranked top 30 in terms of the volume of neuro-interventional procedures. Zylox has had a slightly different approach, not having built a presence in the U.S. (yet), and intensifying registration efforts in South America and the Pan-Asian regions.

Zylox-Tonbridge international expansion

Profit margin drivers

MicroPort and Zylox have similar profit margin drivers. However, MicroPort is already a much more mature company and sported EBIT-margins (excluding government, grants, interest income, etc) of (well) over 30% in the two most-recent half-year periods. Zylox is a younger company, operates across a much wider range of product verticals… which I suspect gives it more growth potential. Consequently, Zylox is not as productive/efficient (yet), and only just became profitable in 2024H1.

Productivity/efficiency - MicroPort NeuroScientific (left), Zylox-Tonbridge (right)

As we have seen, margins are sensitive to regulations. Everytime a specific product category starts the volume-based procurement (VBP), for instance, gross profit margins tend to take a hit.

Below the cost of goods sold line, medtech companies have been demonstrating a LOT of operating leverage on R&D, Sales, and Adminstrative costs. That is not so difficult to understand. These companies needed to build out most of their product development, sales, regulatory capabilities, international (sales) offices, et cetera, before they could start to really scale-up product sales. Incremental revenues should continue to come in at much lower incremental costs.

I also believe that the introduction of VBP policies led to changes in the relationships between the medtech companies and their distributors, with the distributors suffering disproportionally from the end-market price declines. MicroPort has been vocal about switching distribution model - to direct sales - in various international countries. I need to dig a bit deeper to see how distribution models have changed in China. I suspect that roles and responsibilities between distributors and manufacturers are changing, and that a larger share of customer engagement and service will be brought in-house. MicroPort’s 2019 annual report did indicate meaningful changes, like » “industrial integration will be accelerated”;

The National Health Commission also identified the pilot cities for integrated health care system which aimed to form synergy of medical insurance and medical reform. Under the guidance of the above reform plans, major provinces and cities have successively introduced centralized high-value medical consumables procurement policies, resulting in the downward prices in end markets. However, a series of innovative supporting measures will help reduce operating costs and in the long-run, industrial integration will be accelerated by establishing reasonable pricing mechanism to eliminate less competitive counterparties, which will provide greater market opportunities and a healthier development environment for industry leaders engaged in innovative and large-scale production and thus leading to high-quality development of the industry.

Zylox mentioned…

Despite the ongoing centralized procurement processes, our gross profit margin has remained relatively stable, holding at 71.3% in the first half of 2024. This stability is attributable to continuous optimization of our production and supply chain, including increased automation, improved yield rates, and enhanced capacity utilization.

MicroPort NeuroScientific - R&D, Distribution, and Administrative costs, in CNY million and as % of revenue

Zylox-Tonbridge - S&D, R&D, and Administrative costs, in CNY million and as % of revenue

Further below in the P&L, tax rates are bound to go up. Zylox was loss-making until recently and should have at least a couple of years of loss carryforwards. Eventually, of course, the taxman will get his cut of the business.

Invested capital

Invested capital mostly comprises PP&E and Capitalised R&D costs. Again, MicroPort is further along the development curve. Its capex is already down to about 6% of revenues, whereas Zylox is probably near the peak of its capex requirements. In 2023, Zylox spent CNY 191m or 36%(!) of revenues on capex. At the end of June, it still had over CNY 200m in un-utilized proceeds from the IPO to build/expand R&D, manufacturing facilities and offices.

At the moment, capital intensity is quite high for both companies. Nevertheless, MicroPort is already generating returns on invested capital in the strong double digits.

Capital allocation

Both companies have been returning capital to shareholders for a little while now. MicroPort started with a (scrip) dividend. More recently, it paid a cash interim dividend for 2024H1, and started share repurchases. Zylox was earlier with buybacks, despite still being loss-making at the time. Management has commented that dividend payments are to start in 2025.

Valuation

In general Hong Kong MedTech stocks have been horrible investments since many of their listings in the 2021 - 2022 period. While revenue growth since that period has mostly been very high, the starting price-to-sales multiples were simply far too high. In addition, investors have likely been concerned about the threat of pricing (and overall economics) erosion due to the introduction of the centralized volume-based procurement.

Currently, several companies already have some critical mass and profitability… and their EV/Sales valuation multiples have dropped to levels near of even below the levels of slower growing peers/competitors in the U.S. I believe that creates an attractive risk/reward IF you believe in several more years of high revenue growth, in (some cases in) combination with profit margin expansion.

TIKR.com peer valuations, 2024/10/04

NB: 9996.hk, 6609.hk are still heavily loss-making

I have had a preference for Zylox-Tonbridge. The company seems to have the widest product range, making it the closest to a one-stop-shop among the Chinese players. Moreover, I found Zylox-Tonbridge’s track record the most impressive. It started from a smaller revenue base and subsequently overtook many of its competitors, without that coming at the expense of gross profit margins. Finally, c60% of the market cap is covered by FAV.

MicroPort NeuroScientific (fka MicroPort NeuroTech) has been the clear #1 among the Chinese neurointervention companies. The company is more mature and has a more narrow product offering with a larger focus on hemorrhagic stroke and cerebral artery atherosclerosis stenosis products. Hence, it’s operating profit margin (including other income) (2024H1: 44.7%) is already much higher than Zylox-Tonbridge’s (2024H1: 12.5%), which only recently became profitable. As a result, it is also easier to see the valuation case for MicroPort with, for instance, a free cash flow yield that is likely already going to be (near) mid-single digits for 2024e.

Risks

Beside the usual risks, key specific risks MicroPort and Zylox include;

Regulatory changes; The scope of centralized procurement in the peripheral and neurointerventional fields continues to expand. The resulting price reductions may hurt profit margins more than expected.

Growth expectations may be too high, particularly after the recent share price jumps.

MicroPort NeuroScientific

MicroPort is the Chinese pioneer in the neurointervention industry. In 2004 , the company's first product, APOLLO, was approved by the State Food and Drug Administration and became the world's first approved stent system for the treatment of intracranial atherosclerotic diseases.

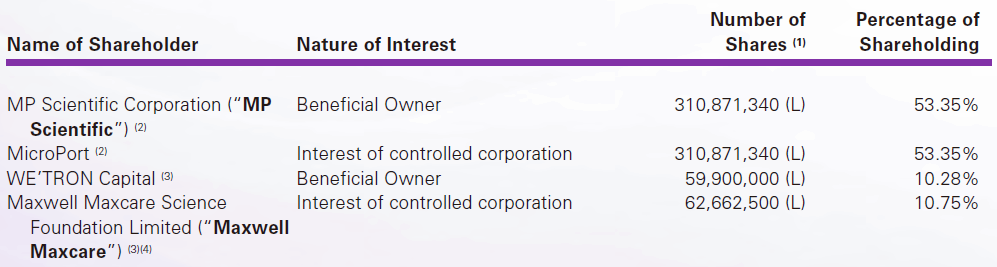

In 2022, MicroPort NeuroScientific was spun-off from MicroPort Scientific $853.hk, which has incubated and spun-off a number of MedTech companies. MicroPort Scientific still owns a 53% majority stake in NeuroPort NeuroScientific.

MicroPorts product portfolio of commercialized products covers three major areas of cerebrovascular diseases, namely hemorrhagic stroke, cerebral atherosclerotic stenosis and acute ischemic stroke. According to Frost & Sullivan, the Group’s market share in China’s neuro-interventional medical device market ranked the fourth place in terms of the sales in 2023 while ranking the first among all the domestic brands.

MicroPorts has a dominant position in cerebral atherosclerotic stenosis with “market shares of the Group’s APOLLO™ Intracranial Stent ranked the first (approximately 60%) and the market share of Bridge® Vertebral Artery DES ranked the second (approximately 50%) in China in terms of the implantation volume in 2023.”

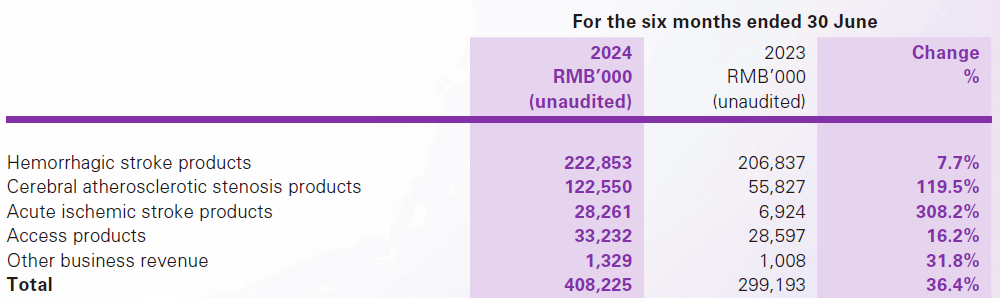

Revenue breakdown

The Group has developed multiple “First-of-Its-Kind” products and “One-of-a-Kind” products, including the world-first stent system for treating intracranial atherosclerotic diseases in the world, the world-only intracranial stent graft approved for treating cerebrovascular diseases, the first Chinese-developed flow-diverting stents approved by the NMPA, and the first vertebral artery drug-eluting stent in China that has been admitted to the NMPA’s special review procedure for innovative medical devices (the “Green Path”) and approved by the NMPA.

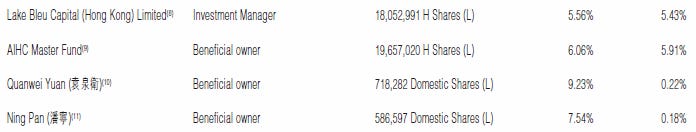

Shareholders’ structure

Directors and executives ownership

Zylox-Tonbridge

In November 2012, Dr. Jonathon Zhong Zhao (趙中) founded Zhejiang Zylox, after serving as associate director at Guilford Pharmaceuticals (now part of Eisai Co., $4523.T)) from July 1996 to June 2002, and as lead scientist at Cordis Corp, a Johnson & Johnson (now a Cardinal Health company) between July 2002 and August 2011. Dr. Zhao is still leading Zylox as its Chairman/CEO, holds about a 13% interest, and jointly controls the company through a Concert Parties Agreement with several other shareholders.

In 2018, the neural implants and interventional medical device company Zhuhai Tonbridge joined the vascular medical device company Zylox to creat Zylox-Tonbridge.

Revenue breakdown

Shareholders’ structure

Directors and executives ownership

Healthcare stock investing

I see the healthcare (HC) sector as one that offers an above-average portion of high quality companies, given characteristics like Growth, ROIC and FCF.

Why?

Moats; The sector is the home to an above-average portion of companies with a moat. Companies with a business model that is shielded from the most severe competitive intensity. Examples of such moats include

Patent protection on medicines

Regulatory capture; The product is included in a regulatory approved treatment. Therefore substitution of the product would require new lengthy and costly clinical trials. While still very early days, I believe over time examples will include the delivery technologies of ClearPoint Neuro and MaxCyte.

Switching costs; Once a large base of medical specialists are trained with a particular product or procedure that is effective, that creates an immense time and cost hurdle for a substitute.

Ageing population; Structural growth is likely going to get harder and harder to come by for many companies, simply due to demographics. Population growth has been slowing, and is already declining in several large geographies. That removes an important growth driver for many companies.

Population ageing increases the need and demand for healthcare, and we have visibility on this for quite some time.

How and what?

Now, I am definitely not an healthcare specialist. I just try to know enough about an industry to make a reasonable assessment of the risk/reward for a particular stock. You will not see me analyzing the chances of success for a particular pipeline product of a biotech/pharma company. I believe even most of the pharma experts don’t get that right consistently. As such, IF I do something in the sector, it is usually in the healthcare IT/equipment and life sciences tools industries.

Generally, I look for staples-like characteristics, ie customer loyalty, pricing power, recurring revenues, etc. From there, it regularly becomes a game of statistics. Scaling-up with strong execution and attractive valuations. Scaling down when the risk/reward becomes less attractive. I have heard too many times; Ooo, the management team is the best, or Ooo the product pipeline is the best… eventually leading to disillusions. There are just not that many companies and management teams that keep on delivering on the promises. To prevent getting a big haircut in those situations where stocks disappoint, it helps remembering Warren Buffett’s Rule #1…

…No, not that one 🤪.

Warren Buffet:

“Rule #1: Never lose money. Rule #2: Never forget Rule #1.”

Easier said than done of course… but we can try! Scaling up and Scaling down according to the risk/reward tends to work for me.

Disclaimer

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

Footnotes

Neurointervention

Neurointervention is a minimally invasive surgery to clear and repair cerebral vascular pathways. Neurointervention refers to the use of auxiliary devices such as catheters to deliver therapeutic devices to the diseased blood vessels through femoral artery puncture with the support of digital subtraction angiography (DSA), and to perform intravascular treatment through thrombectomy, dilation, embolization, etc.

Neurointerventional surgery is the main treatment for neurovascular diseases and has many advantages. Neurovascular diseases have a high incidence and prevalence and are the main cause of death in the Chinese population. The main treatments for neurovascular diseases include: intravenous thrombolytic therapy, open neurosurgery and neurointerventional surgery. Among them, neurointerventional surgery is a minimally invasive surgery that uses radiology and advanced image-guided technology to treat neurovascular diseases. Compared with intravenous thrombolytic therapy and open neurosurgery, it has many advantages, such as a relatively long treatment time window, reducing patient side effects, reducing the risk of post-operative infection, and providing a key alternative for patients who do not meet the conditions for intravenous thrombolytic therapy.

Peripheral vascular intervention

Peripheral vascular disease includes peripheral arterial disease and peripheral venous disease. Peripheral arterial disease (PAD) is a disease of blood vessels outside the heart or brain. PAD often occurs when platelets block or narrow the arteries that carry blood to the arms, legs, and internal organs. Peripheral arterial disease is the third leading cause of atherosclerotic vascular disease after coronary heart disease and stroke.

Product portfolio & pipeline MicroPort NeuroScientific

On 2024/06/30, NeuroPort had a total of 21 products that have been approved and commercialized in China, and 14 pipeline products at different development phases. Among them, four products have been approved by the NMPA to be admitted to the Green Path, ranking the first among Chinese neuro-interventional medical device companies.

Product portfolio & pipeline Zylox-Tonbridge

On 2024/06/30, Zylox had a total of 44 products commercially launched in China, eight products granted CE Mark in the European Economic Area, five products approved in the United Arab Emirates (UAE), and a number of products granted marketing approval in overseas countries including Germany and the U.K., etc.

Neurovascular interventional products

Peripheral-vascular interventional products

Centralized volume-based procurement (VBP)

VBP aims to lower the price of medical consumables by tendering the market volume of cities, provinces or the country to manufacturers with the lowest price.

With national VBP the government centralizes its purchasing power. It also allows for more standardised and transparent procedures and reduces opportunities for corruption. Furthermore, the standardised process for bidding and procurement across the country reduces the need for individual provinces or hospitals to negotiate with multiple suppliers, which can be time-consuming and inefficient. By centralising the procurement process, the government can better monitor and track supplies, identify potential supply chain disruptions and take proactive measures to ensure the availability of essential supplies.

The VBP awards multiple winning contracts instead of ‘winner takes all’ contracts, which increases the robustness of supply chains. Winning bidders are guaranteed a considerable market size of the total annual consumption, providing the public payer with significant bargaining power over suppliers. The guaranteed quantity also creates economies-of-scale and eliminates possible supply and demand mismatch, allowing suppliers to lower costs.

Patients can often still choose non-bid-winning products. In that case, they have to pay out of pocket for the difference between the actual prices and the VBP bid-winning price.