Portfolio update #13 (f🔐) 10%+ divi stocks

This Portfolio post talks about dividend income investing, and introduces two double-digit (10%+) dividend yield stocks

Table of Contents

Dividend income investing

The mysterious ‘Others’-line

Jaminvest resources

Portfolio

Hong Kong (sub-)portfolio

Disclaimer

Footnotes

1. Dividend income investing

1.a. Intro

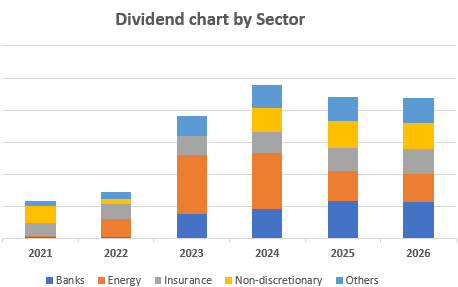

Since 2021, The portfolio’s dividend income has quadruppled. Last year’s portfolio dividend yield even approached almost 6%! That is quite something, because I did not at all consider myself as a high dividend investor.

1.b. What happened?

Well basically a mix of two things…

A strategy to increase dividend income towards a level that covers fixed living expenses, and

Mr Market offering double digit (10%+) dividend yield opportunities.

One without the other would probably not have made the same impact of what actually transpired. In a bit, I will tell more about that journey… but first a bit about…

1.c. What’s next?

I do rather like the result of the dividend strategy so far. That means jaminvest will keep being on the lookout to add stocks that can further build and diversify the dividend income stream. Naturally, I prefer to invest in companies with sustainable and growing free cash flows that support the dividend distributions indefinitely… but Mr Market gives what Mr Market gives, like the Tankers 🏷️ trade for instance. If the opportunity is good enough, I’ll happily take a cyclical trade. My main goal is to find additional stocks than can grow to generate at least a 10% annual dividend yield on my cost price.

On the overall portfolio, I would expect that the hidden gems, long tails, compounders - whatever you want to call them - will increase their share of the portfolio over time. That’s usually the simple math because I do not want to become too dependent on individual (higher risk) countries or industries. With that restriction the number of attractive dividend opportunities is usually quite limited in any given year (for my specific portfolio). Moreover, compounders that can re-invest profits at high Returns On Invested Capital (ROIC) should normally see faster share price appreciation vs stocks with a high dividend payout ratio.