Odd lots #3; Dolphin Drilling

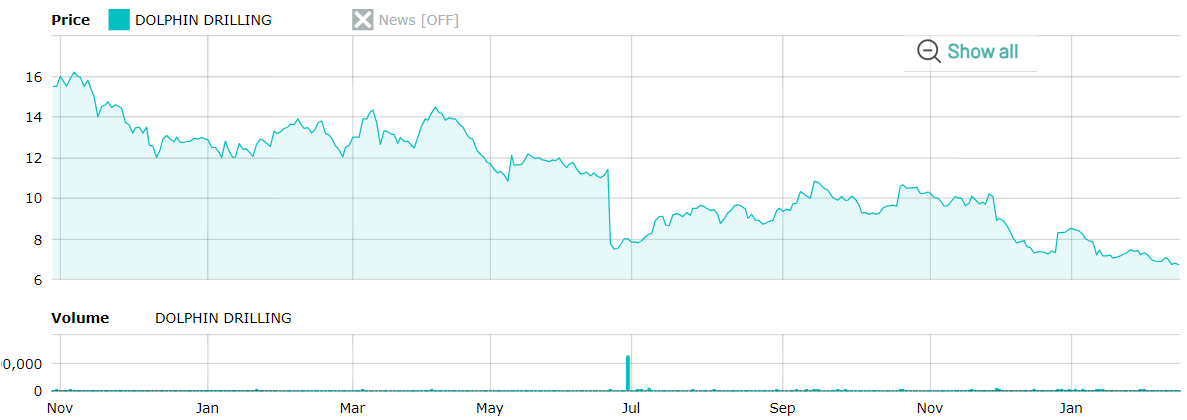

Dolphin Drilling hit some large waves, soon after it floated on the Norwegian stock exchange. Last week's closing of the Transocean rigs acquisition should bring it back into calmer water.

Rough waters

Late 2022, management pitched the Dolphin Drilling $DDRIL.ol IPO with the promise of becoming a dividend stock. The blue sky scenario; Management would seek customers for its three ancient oil drilling platforms, and anticipated generating $150,000 EBITDA/rig/day. With all three rigs employed, this would lead to $100m or more in FCF, and potentially dividend. A $100m dividend on a c$160m market cap at year-end 2022 - 60%+ yield - that does not sound bad, does it?