News & Insights #42

A HK (sub-)portfolio swap *** Results season *** Last week's One-Day Stock doubled in 1 day *** Several new HK high-dividend stocks and/or Dollars trading for Pennies *** And more

Links, references & more

» One-Day Stock #5 » Wise Ally International

$9918.hk

In last week’s post, I suggested a potential big one-day return for Wise Ally on Monday… And so it happened. The stock opened up with a ‘mild’ 😉 40% increase, and ended the day a whopping 108.57% higher. That’s even better than the 82.72% one-day jump on Mexan Limited $22.hk.

I believe Wise Ally is still awfully cheap. At Monday’s HKD 1.46 stock price, the market cap of HKD 146m still reflects only about 2x the HKD 60-80m guided net profit for 2024. The stock closed the week at HKD 1.26.

I digged up some more info on Wise Ally and wrote it down 👇.

That original Founder’s exclusive/priority post is now available on the regular Paid subscription.

Now, I am perfectly aware that illiquid stocks like these are very difficult to play. It does, however, (time and time again) emphasize the opportunity in Hong Kong small and microcaps. There is similar investment return potential in many absurd-cheap HK 第部分. My approach is to just buy a basket - of preferably dividend-paying - Dollars trading for Pennies… and just wait around, collect the divies… and hope for a similar One-Day Stock return. All it takes is a little catalyst. And when Board members of other companies see how easy it is to unlock massive amounts of shareholder value… perhaps more companies will follow with (minority) shareholder friendly actions.

» No more kicking the can down the road?

Quite the change in tone... Ever since the 2008-2009 GFC (that’s the Great Financial Recession for younger investors)… investors have become used to the US opening all cylinders to prevent economic weakness. It seems we’re in a new era. Finally, someone seems to be starting to address the HUGE government deficits and (unsustainably?) rising government debt.

Trump Declines to Rule Out Recession

There is a period of transition because what we’re doing is very big.”

Trump has moved to overhaul the U.S. economy in an agenda focusing on new tariffs, limiting immigration and cutting regulations, government jobs and taxes. He is also looking for spending cuts in a number of federal programs

A tricky environment for (expensive) stocks… particularly of companies exposed to western regions?

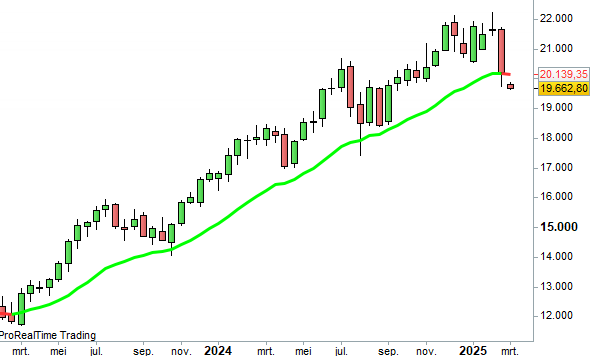

Nasdaq price chart, start of the week

Jaminvest resources

Some useful links to key resources on Jaminvest.

🏷️ - Financial models/templates/et cetera (f🔐)

🏷️ - Hong Kong (sub-)portfolio posts

🏷️ - Portfolio posts (f🔐)

» » - Stock/Company list, alphabetical lists of many of the stocks mentioned

🏷️ - Tutorials including Excel sheets