Imperial Petroleum; Fighting Net-Net status?

If any stock deserved its “Net-Net” status, it is Imperial Petroleum ($IMPP). Normally this stock is un-investable, but that could be about to change.

Net Net

The term “net-net” refers to a specific stock investment situation, popularized by value investor, Benjamin Graham. A net-net is a common stock which trades below a conservative estimate of the company’s liquidation value. There are varying definitions for the liquidation value. In IMPP’s case it is so plainly obvious, that one does not need to argue about definitions.

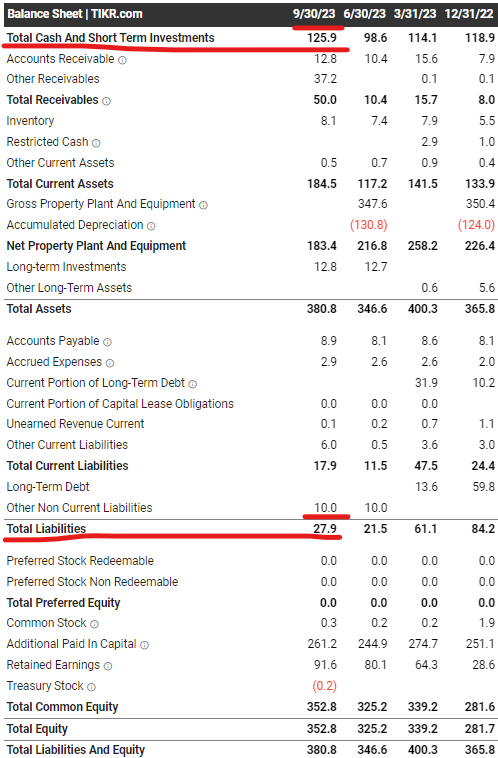

At september 30th, 2023, the cash position stood at $125.9m. After deducting $27.9m in total liabilities, that leaves $98m in very conservative net liquidation value. Compare $98m to the $53m market cap….and guess what? It looks like you can buy $1 for slightly over 50 cents, $98m for only $53m …

On top of that, IMPP will also throw in a profitably operating fleet of product tanker and dry bulk vessels with a book value of $183m (the market value was assessed at a 25% premium to that), and a $15m investment in Series A Convertible Preferred Stock of sister company C3is Inc ($CISS).

That looks like a pretty sweet deal now, doesn’t it?

What’s the catch?

If any stock deserved its Net-Net status, it is IMPP. CEO Harry Vafias has pulled multiple tricks to enrich himself at the expense of minority shareholders. Two of his favorite tricks are

Privately-held fleet management company

Dilutive share issues

The Vafias family controls Stealth Maritime, IMPP’s fleet manager. Through Stealth Maritime, Vafias can extract value from IMPP. Stealth Maritime receives a management fee based on the number of vessels in operation, and a commission of 1% on any purchase or sale transaction with IMPP’s fleet.

Clearly one can spot the conflicts of interest between Vafias and minority shareholders. Vafias can expand the fleet in a value-destructive manner to minority shareholders, and personally benefit from increased management fee income at Stealth Maritime. Moreover, there is an incentive to trade ships between various family-controlled entities using prices that benefit the family.

Fleet expansion is certainly what happened. IMPP started with a fleet of 4 tanker vessels upon the spin-off from StealthGas ($GASS). In early 2023, the fleet reached a size of 12 vessels, in the process increasing the number of shares outstanding from 0.3m to 25.6m (or an estimated 30m+, assuming conversion of the 5.00% Series C Convertible Preferred shares, held by CEO Harry Vafias via Flawless Management Inc), and obliterating the share price. The way Harry hammered the share price and minority shareholders, reminds me of how his namesake “Hatchet” Harry Lonsdale battered someone to death with a black rubber cock, in the movie Lock Stock and Two Smoking Barrels .

Well, if all Harry’s shenanigans have not turned you off yet. What can the future hold for IMPP?

TOP Ships scenario

TOP ships ($TOPS) shares many of the same trades as IMPP; shipping company, run by Greeks, monstrously mistreating minority shareholders … and yet, the share price more than doubled in the past month.

What sparked the sudden change in sentiment? Insider buying, followed by …

…conversion of preferred shares into common stock, lifting CEO Evangelos Pistiolis’ interest to 73% of the common shares outstanding.

Clearly, holding 73% of the company provides a massive change in the incentives for the CEO. This dramatically reduces the likelihood of continued dilutive share offerings going forward. Insider and share repurchases could further help to reduce the current 70%+ share price discount to the $61 fully diluted NAV.