HK 第7部分; It's all about the Benjamins, P2/2

On February 8th, 2024, I introduced my HK portfolio, yielding 7%+. Today, I elaborate on the second of two Benjamins in that sub-portfolio, along with a bunch of other things.

Slash and Puff Daddy : It's All About The Benjamins

Index

Introduction

News & insights

HK 第部分

Benjamin #2

Portfolio

Introduction

Today, we’ll continue with the HK stocks series. The main course is the promised elaboration on Benjamin #2 from the HK (sub-)portfolio. This dinner also includes appetizers with some brief thoughts on both new and familiar names. And of course, no dinner is complete without a dessert, updated thoughts on the portfolio.

As a reminder, the two smallest holdings in the HK portfolio are both proper Hidden gems, generating 20% ROICs and solid FCF. Both companies are trading around 5-9x P/E, but one of them owns its entire market cap worth in (net) cash. So, effectively you can buy it for HKD 0. This post is about that latter Benjamin, and it has not been talked about by any other substack account as far as I know (not in Left field either).

Given how momentum is building for Benjamin #2, I am expecting it to provide a positive profit alert around mid March, followed by the complete full year’s earnings report at the end of March. Paid and founding subscribers can read all about it now. I will update free subscribers (if and) when I open up the elaboration on Benjamin #2 for free.

News & insights

Hidden gems

Petrobras CEO Jean Paul Prates did not make any friends amongst investors by talking up the “Green energy shift”, and pouring cold water on dreams of further extraordinary dividends. Subsequently, one of the biggest Petrobras proponents, Calvin Froedge, threw in the towel. Petrobras share price finished about 6% lower on Wednesday. It seems Petrobras tried to sooth investor concerns later on with the below press release, and the last couple of words in particular; “…to provide predictability to the flow of payments of remuneration to shareholders”.

HK 第部分

Discovery phase; “Left goes to Hong Kong” led to a wave of new interest for absurd cheap HK stocks on Wednesday night (US West Coast time). Thank you so much Left!!

Insiders of this substack know the stock he is talking about. The stock in question was already up 4% with over 2x normal trading volume.

If you do not subscribe to Left’s newsletter (paid), yet. You should! He was a hidden gem, and he has been fast getting discovered thanks to several spectacular stock ideas with groundbreaking indepth research.

Odd lots

Dolphin Drilling reported 2023Q4 results. The company is still struggling to get the bills paid for the rig that is under contract in Nigeria (and the only rig that was operating until the completion of the Transocean rigs acquisition on 2024/02/15). As a result, DDRIL’s balance sheet health is currently deteriorating. Management says it’s close to a resolution, but talks with the customer have been ongoing for quite a while already.

Looking a few quarters out, the future looks brighter with contracts for 3 rigs. But as every seasoned investor knows, a couple of quarters can be a loonnnngggg time in the stock market. Rough waters still.

HK 第部分

As I continue to go through the list of Hong Kong stocks, I keep on stumbling on quite unusual businesses. How about investing in a subsidiary of China’s Ministry of Industry and Information? Who would come up with the idea to sell bird’s nest food and skincare products? If you turn over enough rocks, there is always enough to surprise and amaze you.

I will not go over all of the details of these particular stocks today, but I will leave you with a little flavor.

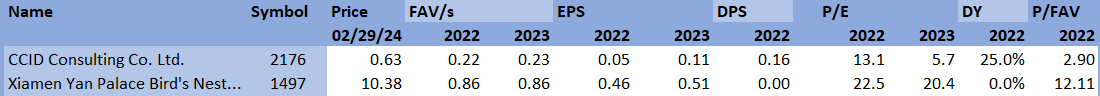

Price: share price, FAV/s: financial assets value per share, EPS: earnings per share, DPS: dividends per share, P/E: price-earnings multiple, DY: dividend yield, P/FAV: share price to financial assets value.

NB, CCID’s 2022 dividend included a special dividend which I believe is unlikely to be repeated. I deducted contract liabilities from financial assets per share. Without this adjustment FAV/share is cHKD 0.40, instead of HKD 0.22.

Yan Palace listed late 2023. I used a share count of 465.5 for all my per share figures.

As usual, these figures are just my rough estimates. I may be horribly wrong.

CCID Consulting Co. Ltd.

CCID Consulting provides “Research+Consultation+Implementation”; innovative integrated services and digital empowerment services for governments, parks and enterprises.

What do I like about it?

Economic models tend to be attractive for consultants. It is a people’s business, implying very little in the way of capital investments, and solid or even strong ROIC’s.

Repeat business; there seems to be quite a bit of repeat business from for instance periodic research reports. Moreover, the company seems to have developed some in-house technology platforms.

Cheap valuation

Dividends can be very attractive. You only have to look back to 2022, which included a special dividend, probably helped by the proceeds of an asset disposal.

High growth verticals; CCID has exposure to new high growth verticals such as digital transformation, big data, and AI. On top of that, CCID’s results were held back in times of covid-restrictions. Revenues and profits are in recovery mode in 2023.

What is the downside? The difficulty is just getting to know the business well-enough to build conviction on it. Please send me info on CCID if you have any. Up until now, I was not even able to access its corporate website! 😞 Of course, you do need to be comfortable with investing in a state-owned enterprise (SOE) as well. The small size of the company - HKD 440m or USD 56m market cap, with limited free float - will exacerbate matters. If you are wrong on the stock, it can get difficult to get out unscatched.

Xiamen Yan Palace Bird's Nest Industry Co., Ltd.

Current valuation multiples and the limited history as a listed company do not entice me to spend too much time on Yan Palace at the moment. Therefore, I will just leave you with some excerpts from the 2023/11/30 Global offering document and a link to a youtube video explaining edible bird’s nests.

“Edible bird’s nests” or “EBN”; Nests created by swiftlets with their saliva. EBN is highly valued in Chinese culture and has been a renowned delicacy in Chinese cuisine for over 400 years. It is known for its nutritional profile, which includes, among others, sialic acid, amino acid, collagen, glycoprotein, antioxidants, calcium, potassium, iron, magnesium and hormones. Traditional Chinese medicine attributes various health benefits to EBN, such as promoting overall wellness, boosting the immune system, enhancing focus and concentration, increasing energy and metabolism and regulating circulation. Modern scientific studies conducted by authoritative sources have further validated the perceived health benefits of EBN products

Supply - P 45/484 - Our ability to control our costs, in part, depends on our ability to secure raw nests, our primary raw materials, from Indonesia, and packaging materials, that meet our quality standards at reasonable prices. Our packaging materials primarily consist of polypropylene bowls (an FDA-approved food contact plastic), glass bottles, cardboard, and metal packaging materials. The cost of raw materials accounted for 76.7%, 79.3%, and 77.3% of our total cost of sales in 2020, 2021, and 2022, respectively.

Suppliers in Indonesia are crucial to our business. We source substantially all of raw nests as primary raw materials for our products from them.

Risks - P 41/484;

The EBN industry in China has historically faced governmental scrutiny over food safety issues, in particular, prior to the publication of the first industry standard for EBN products in China in 2014.

The potential health risks of EBN consumption include excessive nitrite content, excessive heavy metal content, presence of bacteria, and hormonal side effects.

Okay, one more company mention. What happened here?! 🍿

YanGuFang International Group Co., Ltd.

“…the Company has been informed by the family members of Mr. Junguo He, the Chief Executive Officer (the “CEO”) and Chairman of the Board of Directors (the “Board”) of the Company, and Mr. Kui Shi, the Chief Financial Officer (the “CFO”) of the Company that the CEO and the CFO have been detained by certain Public Safety Bureau of Shanghai, China (“Shanghai Police”), and are currently under investigation by said Shanghai Police. As of the date of this announcement, the Company has not received any official notice of the investigation against Mr. He or Mr. Shi or the respective reasons for their detainment.”

YanGuFang International Group Co., Ltd. YGF 0.00%↑ recently listed its shares in the U.S. YGF sells whole grain foods in the People's Republic of China. It offers oat germ groats, oatmeal, oat flour, oat bran, and gourmet rice; and grains, including black beans, red beans, corns, and other grains.

Let’s serve the main course; Benjamin #2, for which I am expecting a positive profit alert around mid March.

Natural Food International

$1837.hk

Recap » $1837.hk is ‘on-trend’ selling healthy snacks and food, mostly via e-commerce and social media channels. The free float is very limited as founder/CEO Mr. Zhang Zejun and his family (including his wife, Chairman Ms. Gui Changqing) own 42.49% of the company, and PepsiCo owns 25.88%.

It is very odd for an on-trend staples company with high ROIC and strong FCF generation to be as cheap as it is. Perhaps investors just do not realize how good the business is. The ROIC’s have been around 20%. Investors may have overlooked that because profit margins are not that high. The ROIC strength is driven much more from low capital intensity.

The current share price basically only reflects the net cash position. Partner PepsiCo bought shares at about 4x!! the current stock price, as Dabao recently pointed out. From what I can tell, I see two key reasons for the absurd low valuation. First of all, dividend distributions have been irregular since the covid pandemic, with no dividends in 2020, nor in 2022, despite the communicated 20-40% dividend payout policy, a very strong net cash balance, and over HKD 600m in distributable reserves. Is the company just being conservative, or is there something else at play? In any case, the retained profits have led to the Retained profits reserve improving from a HKD 8.9m negative balance in 2020, to a positive balance of HKD 193m at year-end 2022, Moreover, with 2023 looking like a record year for profitability and the end of the covid pandemic, it is difficult to come up with reasons for the company to withhold even more money from shareholders. I do expect the company to start distributing dividends again, for whatever that is worth. Secondly, there has been a transformational shift in the business. $1837 used to mostly sell via off-line concessionary corners, an economic model with high gross margins and high selling, general & administrative expenses due to commission expenses. This sales channel has been under a lot of pressure, probably exacerbated by the pandemic. I can imagine that this has created a negative perception with investors. Notably, $1837 has experienced wonderful growth through e-commerce and social media channels. These new channels now account for the majority of overall revenues, 55% mix in the past 12 months.