HK 第42部分; Mental models & 8%+ yield

Mental models & An 8%+ dividend yield Hong Kong stock, named Sun Hung Kai & Co., trading at a fraction of book value

Jam peeling some onions

Table of Contents

Intro

Mental Models

Sun Hung Kai & Co

Jaminvest resources

Disclaimer

1. Intro

EDICO Holdings $8450.hk reported halfyear results, illustrating a great case example of a “thirteen in a dozen” HK 第部分 (= Hong Kong stock). The ingredients…

Substantial part of the market cap covered by FAV (Financial assets value, ie net cash, investment securities, investment properties, et cetera)

✅ HKD 47m on HKD 113m market cap » FAV/Market cap of 41%

Controlled company

✅ Mr. LUI Yu Kin owns 55.8% of the company through Jantix Management

Boring/un-exciting business activity

✅ Financial printing services in Hong Kong

Now the attractive, absurd-cheap HK 第部分 that I am interested in, combine the qualities above with…

Sustainable profitability, preferably through some sort of moat

❌ The H1 loss more than doubled, with revenues heavily under pressure

A low valuation multiple, often around 10x P/E or even lower

❌ Operating losses are rising and the company is burning cash. No point in talking valuation multiples here

A solid dividend yield, often mid-single-digit % of higher, and frequently in the high-single-digits or even better

❌ No dividend in quite some time

… and the really exciting HK 第部分 also offer…

Solid (growth) prospects

❌ Revenue seem to be in structural decline…

The decrease in revenue was mainly due to the further expand of paperless listing regime and the uncertainties in the financial market during the period under review.

Revenue chart

… but alas, EDICO does not screen as an attractive, absurd-cheap HK 第部分… It rather screens like a dying structurally-challenged one 😬, I’m afraid, … with revenue declines, rising losses, and no dividends at all.

The fun thing for me is to go through the 2,760 (according to TIKR) HK 第部分 (not to mention the thousands of stocks in other countries) and discovering the ones that do tick all of the boxes. I can assure you that that is looking for needles in the haystack.

After over a year of looking in Hong Kong, I am pretty pleased with the number of attractive HK 第部分 I found so far. Quite recently I found another bunch of HK 第部分 screening with good promise. So prepare for more HK 第部分 write-ups in the next several weeks.

This post was meant to go through one of them; Sun Hung Kai & Co., that seemed to tick most of the boxes. Unfortunately… and as happens so often when I look at (financial services) companies… I got less and less excited when I checked underneath the hood…

…or was peeling the onion, so to speak. Noooo, not that I noticed anything bad that changed my opinion. What changed was the mental model (to abuse one of Charlie Munger’s terms) I used to approach this stock.

2. Mental models

Probably the 🐐 good ol’ guy 🐐 will turn himself in his grave if he’d read my daft comments about mental models…. Anyways, what I often try to do in investing is to identify stocks of companies that remind me of highly successful proven economic models. That led me to some of my early finds on the Hong Kong stock market such as…

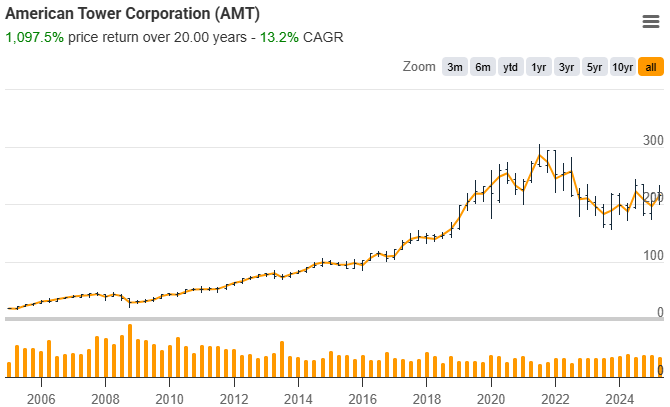

$0788.hk - China Tower 🏷️ » The Chinese monopolist telecom tower operator. The economic model is not as strong as that of the company I stole the idea from…American Tower $AMT.us…

China Tower does not have the inbuilt pricing escalators in its customer contracts like its western peers have… and the company is substantially-owned by its three largest mobile telecom customers. That obviously restricts its bargaining or pricing power… but it is still a ‘moaty’ company. It would take enormous amounts of capital expenditures to duplicate its infrastructure. It is a moaty company, whose stock I felt was just trading way to cheap when I picked it up in early 2024. The (normalized) FCF-yield was several times higher than its western peers, which just seemed ridiculously cheap to me.

$2190.hk - Zylox-Tonbridge 🏷️ was another stock idea I basically copied from its western counterparts. Medtech companies benefit from several ingredients reducing competitive intensity. The products need to receive regulatory clearance before they can be launched on the market launch. And with product market approval, it (often) still takes considerable effort to persuade doctors, and train doctors, to use those medical devices.

Just like with China Tower, Zylox was trading at a dramatic discount vs its western peers (with similar growth) - while 60% of its market cap was covered by net financial assets value - despite arguably (much) better growth prospects.

Again, there are ingredients that make medtech economic models less attractive in China than in western countries. Government-driven centralized volume-based procurement (VBP) policies, for instance, have driven down pricing (in return for a huge pick up in volume for the industry winners). Nevertheless, the risk/reward just seemed incredibly attractive to me last year.

Returning to Sun Hung Kai & Co. or SHKC. When I first stumbled upon the company back in March this year, I thought of it as follows…

What SHKC does offer is superior collateral value and dividend safety. 🤞 And the c9% dividend yield will help me create a compouding effect, all the same, just by redeploying the dividend income stream into more stock purchases.

It looks like an attractive Dollar trading for Pennies to me, controlled by the LEE family, via another HK listed stock; Allied Group Limited (AGL) $373.hk. The situation is a bit similar to Dongxiang. Effectively, I bought a big pot of investments, at a huge discount. The investments are mostly allocated to loans, private equity & hedge funds, and cash & deposits. In the past few years, SHK has paid an interim dividend of HKD 0.12 and a final dividend of HKD 0.14 per share annually, despite incurring investment-related losses in 2022 and 2023. With stronger equity markets in Asia, and a shift in lending practices towards safer, secured lending, I see a good likelihood of profitability in the near-term. The recent Positive profit alert - EPS for 2024 of not more than HKD 0.20 - was already a good example of that.

The market cap stands at HKD 5.8bn vs HKD 21bn book value as of 2024/06/30.

… and a bit later…

I regard it as a bit of a convertible bond given its close to 9% dividend yield, strong financial assets value (FAV), and potential for further profit recovery. A further profit recovery could be driven by stronger equity markets in Asia (ie fair value gains on the (private) equity and venture capital portfolios), and a reduction in credit/impairment losses due to the tightening lending underwriting policies, including a shift from unsecured towards secured lending.

Now looking at the company again, I find myself thinking; Am I not just kidding myself? Shouldn’t I just regard this company as a financial, and, as such, use the Return-on-Equity (ROE) and Price-to-Book (P/B) valuation multiple short-cut (where a 10% ROE, for instance, leads to using a 1x P/B valuation multiple to approximate the fair value)?

ROE chart, by TIKR

Just thinking about that, probably means that I should… and now that I am doing that… obviously, I cannot help but looking at the meazly historic ROE performance, certainly in comparison to my favorite financials between Eastern Europe and Central Asia who have been sporting ROE’s (well) above 20%, consistently.

Still, SHKC at a P/B < 0.30x (HKD 6bn market cap and HKD 21bn shareholders’ equity) and with an 8%+ dividend yield… should earn a better return than a savings account… especially if the Board decides to seriously focus on high ROE activities and return considerable amounts of (then) excess capital to shareholders… which I am definitely not convinced about.

I do find it encouraging that management has been shifting away from higher risk unsecured lending, and towards what should be good fee/margin and low-capital intensive, investment fund distribution platforms. From my, very distant, outsider perspective, I’d say it should not at all be impossible to earn a roughly 5% ROE and cause a re-rating to a P/B multiple of let’s say 0.4-0.5x (driving 40-75% share price upside)… but as I said, I do not hold conviction that that will play out. Moreover, there are lots of ‘easier’, cheap HK stock investments out there.

3. Sun Hung Kai & Co (SHKC) 🏷️

Ticker: $86.hk

Market cap: HKD 6.0bn

Website: https://www.shkco.com

Broker availability; let me use the words from one of our receptionists during our recent China trip; In Chinese Summer, Weather No Problem

Counter to what was my initial plan, I am not going to do an extensive write-up on SHKC. I think your time and mine is better served, Turning over the next Rock. I, for one, have some more promising (non-Financials’) ideas on the shelve.

I will leave you with a few notes from the corporate filings that I already had collected a while back, and with the recommendation to read the company-sponsored initiation report (link below in 3.d. Further Reading) if you still want to learn more.

3.a. SHKC intro

SHK is effectively a large investment portfolio (loans, public & private equity, venture capture and real estate).

In its early years, SHK was controlled by the KWOK family that controls Sun Hung Kai Properties $16.hk. That changed when the LEE family bought control in SHK. Nowadays, the Lee and Lee Trust owns 73.5% of SHKC, via 74.98% ownership of Allied Group Limited (AGL) $373.hk.

3.b. Core business

3.b.i Credit Business

The Consumer Finance business is conducted through 63%-owned United Asia Finance Limited (“UAF”). UAF’s results were pressured due to

rising loan losses (=impairments) on unsecured lending to individuals and SME’s in Hong Kong and China, and

rising finance costs, a predominant portion of which were HIBOR based.

With UAF’s shift to more secured lending, loan (impairment) losses should start falling.

3.b.ii Investment management

3.b.ii.a Public markets

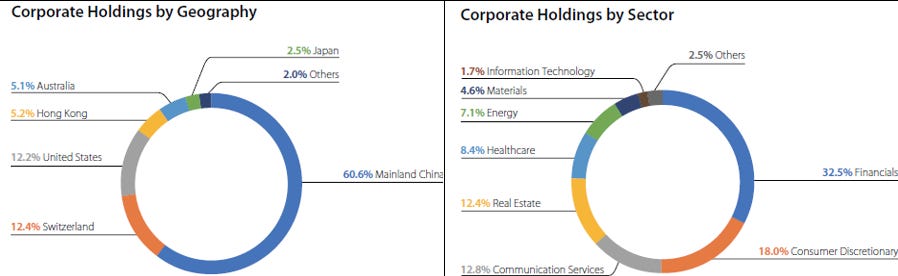

The “Public markets” category is predominantly comprised of “Corporate holdings”, an equity portfolio with a skew towards China/HK and Financials/Real estate.

3.b.ii.b Alternatives

Alternatives mostly comprise private equity and hedge funds investments.

3.b.ii.c Real estate

The portfolio mainly includes the Group’s interests in Hong Kong commercial real estate as well as hotels and commercial investments abroad.

2.b.iii Funds Management

Sun Hung Kai Capital Partners Limited (“SHKCP”) is the regulated entity within the Group to conduct funds management business. At the end of 2023, it had a collective AUM of US$964 million, o/w 37% funded by SHK and 63% by external partners.

3.c. Balance sheet & Capital allocation

Dividends: The Company’s Dividend Policy aims at providing reasonable and sustainable returns to Shareholders whilst maintaining a position of financial stability. In the past few years, SHK has paid an interim dividend of HKD 0.12 and a final dividend of HKD 0.14 per share annually, despite incurring investment-related losses.

Share repurchases: SHK has also done small amounts of share repurchases.

3.d. Further reading

2025/01/20 » Most-recent (company-sponsored) UOB report

2023/12/18 » UOB Initiation (company-sponsored)

2022/12/21 » Seeking Alpha

2021/08/06 » Horos Asset Management 2021Q2 commentary

4. Jaminvest resources

Some useful links to key resources on Jaminvest.

🏷️ - Financial models/templates/et cetera (f🔐)

🏷️ - Hong Kong (sub-)portfolio posts

🏷️ - Portfolio posts (f🔐)

» » - Stock/Company list, alphabetical lists of many of the stocks mentioned

🏷️ - Tutorials including Excel sheets

5. Disclaimer

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.