HK 第4部分; Yum China is not Yum! Brands

A growing number of people has been salivating over the valuation of Yum China Holdings, lately. I want to set the record straight on two often-made fallacies.

Fallacy #1; Yum China is great like Yum! Brands

Yes, it is true that certain restaurant brand owners like McDonald’s ($MCD) and Yum! Brands ($YUM) have great economics. However, it becomes a fallacy to assume Yum China Holdings ($YUMC) is the same type of animal.

Franchisors; MCD and YUM are brand owners and franchisors/licensors. Franchisors provide franchisees/licensees (or franchise restaurants) their brand, technology, food recipes, marketing, et cetera. It is this business model that creates wonderful economics. A franchisor receives a % commission on the revenues generated by franchise restaurants (irrespective of their profitability). That revenue stream grows with the expansion of the restaurant network, without any capital expenditure requirements for the franchisor, and without high incremental operating expenses. The result; a business with very high profit margins, and low capital intensity » high returns on capital (ROIC) and strong free cash flow (FCF) generation.

Yum! Brands

Yum China

Franchisees and restaurant operators; As you can see in YUM’s business despription above, YUM is predominantly a royalty business. It collects franchise fees from 98% of the restaurant network. YUMC is almost the reverse of YUM. YUMC operates c88% of its restaurant network, and pays a 3% license fee to YUM.

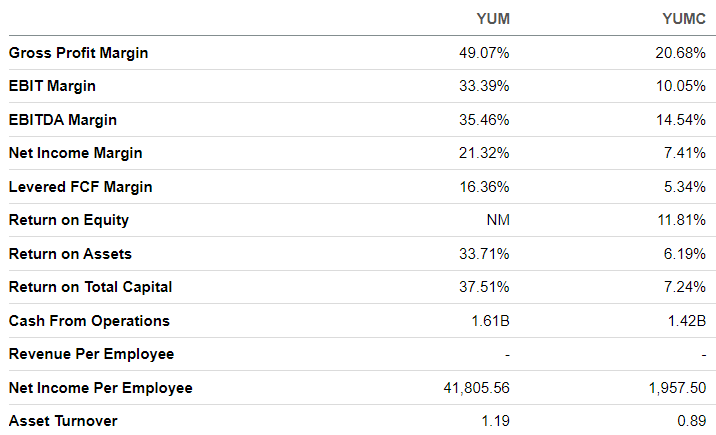

The table below (source: Seeking Alpha), clearly shows the superiority of YUM’s franchisor model vs YUMC’s licensee/operator model. YUM’s profit margins and returns on capital are several times higher than those of YUMC. These differences justify a much higher valuation multiple for YUM vs YUMC.

Fallacy #2; A U.S. P/E multiple on a Chinese business

YUMC may be looking very cheap in comparison to U.S. restaurant companies. The table below (source: TIKR.com) shows that it is far less of a bargain in comparison to other Chinese restaurant operators.

Conclusions

YUMC is not YUM; YUM clearly has the superior economic model

YUMC may be looking attractively valued, but that’s a common feature among Chinese/Hong Kong stocks at the moment.

Judge for yourself whether YUMC currently makes for a great investment opportunity. When you do, also ask yourself two things;

Do I want to invest in Chinese businesses at the moment, given the obviously low (and often absurdly low) valuations?

If so, is YUMC the best stock to play this opportunity?

Next post; Hong Kong stock positioning

In one of my next (paid) posts, I am going to detail how I am taking advantage of bargain opportunities on the Hong Kong stock exchange. Subscribe, if you want to be the first to read it.

You should look at it on a per store ROIC. Full franchised business obviously would have higher returns - that's the purpose of franchising.

Thanks for providing this direct comparison.