HK 第35部分; One-Day Stocks #4

A recap of the Hong Kong stocks journey thusfar... an overview of One-Day Stocks... some new names... and a HK stock exit

1. Intro

This HK 第部分 mini-series started with the Mexan Limited $0022.hk special situation.

Mexan announced…

to sell a hotel property, worth 5x(!!) its entire market cap at the time, and

to distribute part of the disposal proceeds to shareholders.

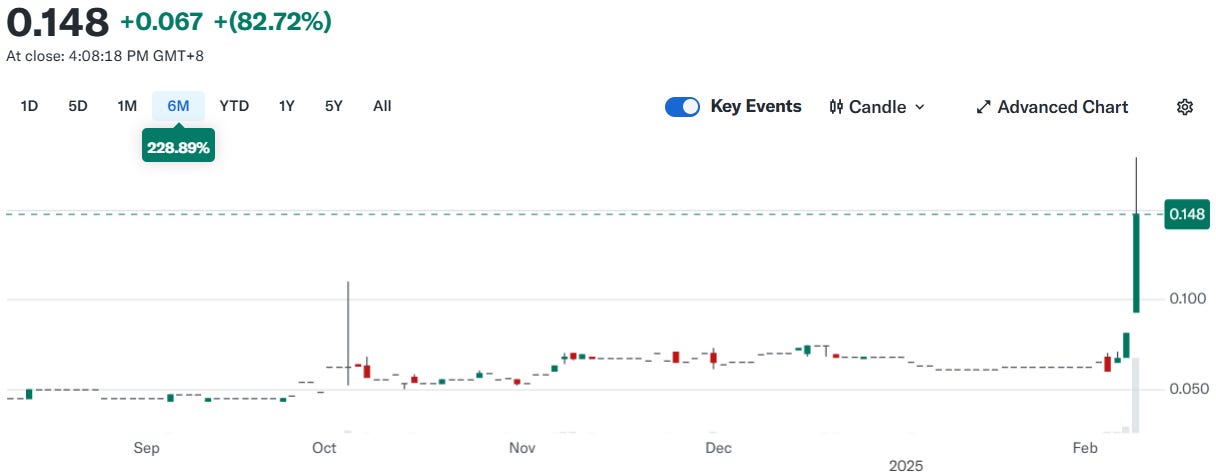

The latter implied that the Mexan stock traded at a one-time 150%(!!) dividend yield. It’s no surprise what happened next… the stock price jumped 82%(!!) on the day. A proper one-day stock.

In this One-Day Stocks mini-series, I am investigating other Hong Kong stocks that hold similar potential as Mexan. That means…

Financial assets value (FAV) exceeds the market cap, preferably multiple times over » ie they are: Dollars trading for Pennies.

Even after selling (a) Financial asset(s), there is still a continuing business operation.

The Board is likely to distribute (at least some) sale proceeds to shareholders » triggering One-Day Stock returns.

Financial Assets Value (FAV): Net (excess) cash position + Investments in equity/bond/etc securities + Investments in Associate/JV companies + Investment property + et cetera. FAV is basically all the silverware, or trophies or however you want to call it, collected by the Board, which are not strictly necessary to operate the actual core business operations.

This post walks through an overview of Dollars trading for Pennies. Then discusses some new potential One-Day Stocks, and finishes with the Hong Kong (sub-)portfolio from which I sold one position. But first; a reminder about my strategy with HK 第部分.

2. Jam’s HK 第部分 strategy

Obviously, my strategy with Hong Kong stocks is not too different from how I run my overall portfolio (available under the Founders subscription), in which HK 第部分 still represent < 20% weight.

What is different is the opportunity set. The vast numbers of absurd-cheap stocks with market caps substantially… one-time… or even multiple times covered by FAV is just unrivalled in Hong Kong. The opportunity to buy high dividend yield stocks with considerable margin-of-safety is, likewise, superior in Hong Kong. Finally, for similar quality type stocks, the Hong Kong alternative is usually considerably cheaper.

So what is the strategy? Very simple, filling up the portfolio - one by one - with solid risk/rewards. Creating a portfolio of stocks that has a high likelihood to help wealth preservation (in the fight of losing value against inflation and taxes), and preferably, wealth creation. Finally, I prefer having a solid stable of dividend paying stocks that covers a good chunk of fixed living expenses… creating additional piece of mind, and financial flexibility.

When I started buying Hong Kong stocks late 2023 and early 2024, I first focused on absurd-cheap stocks of quality businesses. That lead to positions in amongst others…

China Tower 🏷️; The monopolist telecom towers company in China. A critical infrastructure provider for the mobile telecom operators. These type of businesses were valued a ton in western countries. Not in China.

In a ‘normal’ year the company generates RMB 20bn+ in free cash flow (FCF). That means it traded roughly at a 15% FCF-yield. Western equivalents were trading well below 5% FCF-yield and with much more debt. Is China Tower as good of a business as the big western counterparts? Probably not. It has - for instance - less pricing power because its main three (mobile telecom operator) customers are also its key shareholders. Does that justify a 3x lower valuation for China Tower. I bet NOT… and Mr Market has started to agree with me. While the stock has already re-rated quite a bit. In fact, it recently set new multi-year highs… indicating the advent of a new bull-market for Hong Kong stocks? I believe the stock still offers a 6-7% or better dividend yield looking out about 2 years.

Tianjin Development 🏷️; This is still one of my favorite HK stocks. Many investors may not regard this SOE conglomerate as such… but Tianjin Development does own quality. The stake in the Chinese elevator joint venture with Otis Worldwide is incurring cyclical headwinds. The decline in the Chinese real estate market obviously affects new elevator installations… but we are probably closer to the end than the beginning…

…and Otis China is adapting with cost savings, and a mix shift towards the more lucrative maintenance and services market.

Is Otis China as good of a business as its parent co. Otis? Probably not. The Chinese market is more fragmented, and competitive… and the (high-margin) service business is not as big of a piece of the overall business yet. Is it fair that Tianjin Development shareholders are effectively marking Otis China at a deeply negative valuation? Heck NO! Not in my opinion.

Remarkably enough, not only is the stake in Otis China likely worth more than the Tianjin Development market cap in its entirety… the same goes for the stake in Tianjin Port Development… and the net cash position… and… You get the point.

After the first batch of absurd-cheap stocks of quality businesses, I started to focus more on growth stocks (and hopefully future quality) at substantial discounts vs western peers. That lead to amongst others…

MicroPort NeuroScientific 🏷️; The leading domestic player in neurointervention. Neurointervention is a minimally invasive surgery to clear and repair cerebral vascular pathways.

Until a few years ago, various market verticals in Chinese medtech were absolutely dominated by western players. That’s been changing… no doubt, the US-Sino trade war played its part in that. Supported by a steady flow of product launches and government-led centralized procurement initiatives, domestic companies have seen rapid market share gains. Add in the already solid underlying demand growth - due to an ageing popolution - and you get years of strong expected revenue growth.

Remarkably, this domestic leader was up for graps for well-below 20x forward EPS… while holding well over a quarter of its market cap in FAV, already paying out a small dividend, and buying back some shares.

Most-recently, I have been doing more work on potential One-Day Stocks. Dollars trading for Pennies that just need a catalyst to unlock tremendous shareholder value. With the proper catalyst these stocks can return years of performance in just one day, as we recently saw with Mexan Limited.

The research and write-ups I do for the different ‘types’ of stock investments really varies.

For the first two categories, I do more work to understand the business case, and I write more about the businesses (if such write-ups are not yet available). Do check the Stock/Company list and the Tracking Jam Stocks posts for that.

With the last category and ultimate deep value stocks… there is usually not too much of a point. The key there is just to get a rough idea of the absurdness of the valuation… and if it is stupid-cheap enough and the (fraud, governance, business erosion, etc) risks are not too high, then that’s usually good enough. Naturally, as I learn more over time, I’ll write about it. My focus with monitoring these type of stocks is more on identifying catalysts to unlock shareholder value, than on the business operations.

3. Dollars trading for Pennies

Dollars trading for Pennies were big inspirations for me to increase my energy on jaminvest in early 2024.