HK 第31部分; High dividend yields, pt.1

Ouch... there are just so many Hong Kong stocks on the high dividend yield screen .... surprise, surprise... this is going to be a multi-part series

Intro

released a couple of lists of high dividend yield Hong Kong stocks, and asked … As always, what are your thoughts? So, let’s skim through the list and provide some thoughts! This post will go through the double digit % dividend Hong Kong stocks on the first list. Probably, I will follow-up with a look at the other names.TL;DR » Unsurprisingly, it remains a challenge to find quality businesses with sound prospects among the many, many high-dividend yield and/or absurd-cheap Hong Kong stocks.

The three highest ranked divi stocks at least look decent enough to have a closer look;

Greentown Management Holdings

Topsports International Holdings

Hang Lung Properties

Have a look for yourself…

Greentown Management Holdings

Symbol: $9979.hk, Market cap HKD 6bn

Description

The Group is the pioneer and leader of China’s real estate asset-light development model. Greentown Management was founded in 2010. It is a subsidiary of Greentown China ($3900.hk). The core business includes commercial project management, government project management and other services.

Quick thoughts

I have mostly been shying away from real estate related businesses, but already learnt that some of the Property management service providers have attractive characteristics; growth, asset-light (barring the accounts receivable collection problems), high dividend yields, high FAV (financial assets value), et cetera. They do typically come with (the risk of) elevated (and aged) accounts receivable balances. Quite often these receivables are outstanding with a related-party Property development (former) parent co.

In 2023, the Board maintained the 80% + 20% special dividend policy, leading to a final dividend of HKD0.44 per share and a special dividend of HKD0.11 per share. It does not do interim dividends.

Conclusion

✅ Yep, this does look like a 10%+ dividend stock worth further investigating. Still not sure about property market exposure though… 🤷♂️

Topsports International Holdings

Symbol: $6110.hk, Market cap HKD 17bn

Description

The Group has built a consumer-centric, largescale, omni-channel, multi-brand, and multi-category retail operation, operating over 6,000 directly-operated stores mostly for western Sports & Outdoors brands.

Quick thoughts

Key figures for the last FY look pretty decent…

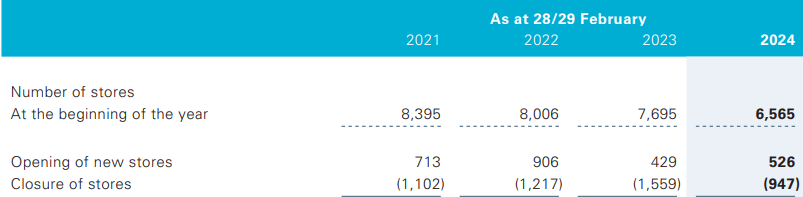

Looking a bit further exposes one of the problems…

Retail is incredible competitive, and Topsports has had to down-size the store network. I always prefer seeing management teams close stores, as opposed to letting the economics erode and ending with loss-making stores.

As we move forward, our commitment to quality development will continue to help us deliver dependable and sustainable returns to our shareholders while elevating shareholder value. Sustainable returns and elevating shareholder value… Who does not like that?

Conclusion

✅ Yep, similar to Greentown Management, this does look like a 10%+ dividend stock worth further investigating. Topsports also operates in a tough industry environment. No wonder that the share price has been under pressure. Not sure whether I want to invest behind western brands in China. 🤷♂️ Domestic brands have been re-capturing market share across various industries as of late.

Hang Lung Properties

Symbol: $101.hk, Market cap HKD 29bn

Description

Property rental business around high-end shopping malls and offices?

although our business is not uncommon in and of itself (there are many companies with luxury mall portfolios in China and others with high-end offices), we are quite unique in that no one else has the same level of concentrated exposure to these segments as we do. Our closest competitors have, in addition to their luxury malls, either a huge supply of mid-size and mass malls as well as residential real estate, or much more significant exposure to Hong Kong as a percentage of their revenues. Therefore, it is difficult to benchmark us against our peers in the market since there are no truly direct comparables.

Quick thoughts

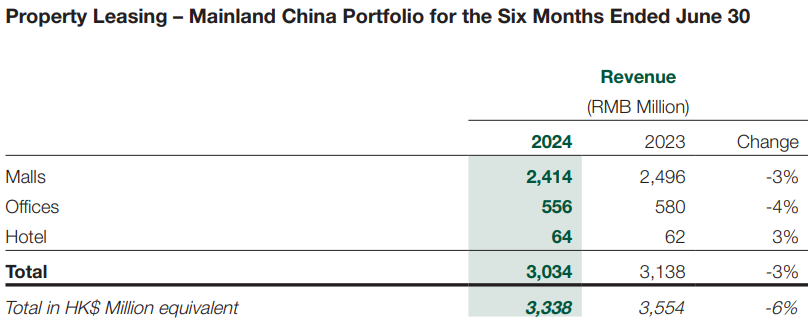

Yep, a property rental business alright…

…skewed towards Chinese shopping malls…

It certainly offers a 10%(+) divi yield. That dividend cover seems under pressure. Can they keep up paying that HKD 0.78 divi?

Conclusion

✅ This is getting very monotonous; another depressed share price, high dividend, tough neigborhood. 🤷♂️

CITIC Telecom International

Symbol: $1883.hk, Market cap HKD 8bn

Description

Great when you can tell what a company does just from its name.

Quick thoughts

Not sure I want to consider anything else than monopolist China Tower in the Greater China telecom space… but let’s give it look anyways. I appreciate that CITIC does earnings calls…

In the first half of 2024, with a number of external challenges, the group has demonstrated strong determination and resilience to develop according to the right course and innovating and forging ahead while continuing to consolidate our traditional telecoms business. We have also seized the opportunity to promote new generation of information technology and also deepen the integration of real economy with the digital economy to grasp such opportunities, and we have pushed forward with transformation and development of digital intelligence.

In the first half of the year, the group's total revenue amounted to HKD 4,889 million, year-on-year decrease of 8.2%. Revenue from our principal telecom services amounted to HKD 4,160 million, year-on-year decrease of 11.3%, and profit attributable to shareholders amounted to HKD 455 million, year-on-year decrease of 36.9%. Basic earnings per share amounting to HKD 12.03, a year-on-year decrease of 36.9%. The group places a lot of emphasis on shareholders' returns, and the Board of Directors had declared an interim dividend of HKD 0.06 per share for 2024, in line with the same period last year.

That sure does not sound like it is better than China Tower, now does it?

Some activities;

CTM (subsidiary) had over 50% market share in Macau mobile market

CITIC Telecom CPC (cross-)sells cloud, network, smart and security products

Acclivis (Southeast Asian subsidiary in Singapore), partnered with a globally renowned major hardware provider to offer service deployment for local customers. And in Malaysia, Acclivis has successfully completed multi-data center ICT projects.

Earnings call Q&A…

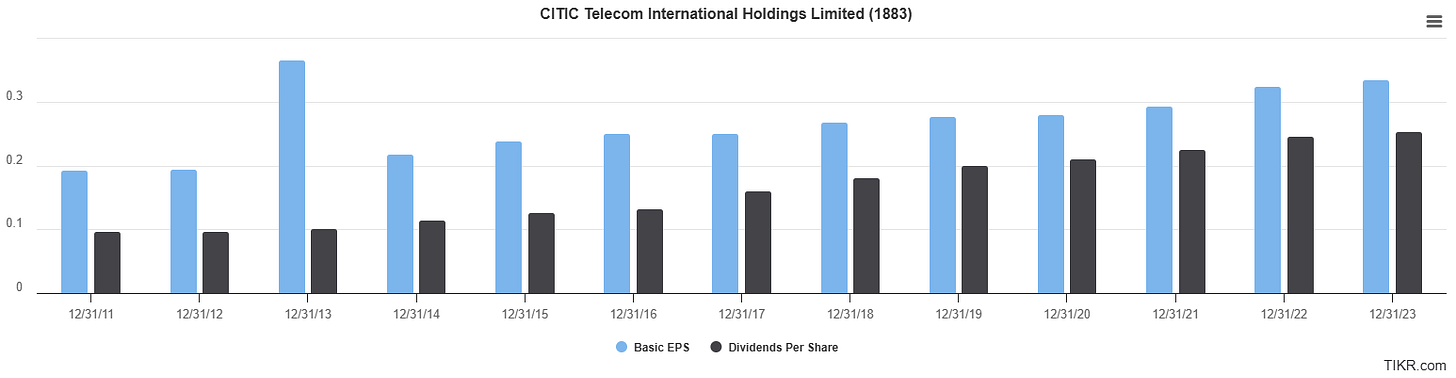

Analyst question: First of all, returns to shareholders in the past, over 10 years, we have been growing in dividends in absolute terms. This year, we understand, for international telecom, there are some pressures how. So how do we consider this year's dividend payout?

Anwer: I would want to thank you your concern about the dividend policy of our company. And as you have mentioned, in terms of dividend payout, we have been consistent. You have noticed that the level is the same. Basically, it is the same at 75% to 77% payout ratio.

And you have also noticed that because of our messaging business decrease, for our revenue and profit this year compared to same period of last year, there is a relatively big drop. But at the same time, we will be, together with our shareholders, sharing the fruits of our efforts in the first half of the year. Even though we have been adversely affected, but our dividends will be the same. It's the same as the same period of last year.

And going forward for our dividend payout, we will continue to develop in new areas, open up new markets. And hopefully, with these new businesses, we will be able to supplement the messaging business drop. So please be assured, we will definitely, according to our profit situation, our cash flow and also our main areas of development in the future, to stabilize our dividend at a good level.

Conclusion

❌ HKD 0.25 divi on a HKD 2.25 stock, according to TIKR. Again with revenue pressures. I’ll stick with my preference for China Tower thank you very much.

Midea Real Estate Holding

Symbol: $3990.hk, Market cap HKD 4bn

Description

I wanted to discard this one right away, as Jam already learnt in the ‘90s and ‘00s that property development is just a …. how can I put it …. 😬😬😬 … delightful …uhum uhum … business 🤢

Let’s give it another second because Midea seems a bit broader than just development. For the operation business of property management services and commercial management, the Company focused on strengthening its light-asset operation capabilities, developed third-party business …

Quick thoughts

At least they are still profitable…

The business is really still predominantly a property developer judging by the 2024H1 revenue breakdown:

RMB 24,104m property development and sales

RMB 840m property management services

RMB 189m investment and operation of commercial properties

The balance sheet says the same with lots of debt and contract liabilities.

Conclusion

❌ Too risky for me

Other double digit % divi stocks

These are 8 other double digit % divi stocks just on the first list alone…

I hold no interest in these. I discard banks and most financial services companies because there are other countries where business like these benefit from far superior industry structures and economics. Similarly, I prefer to ‘play’ commodity type companies in other countries as well. I hold no conviction whatsoever on the regulatory outlook for education businesses or companies like PAX Global. Finally, I also try to mostly avoid capital-intense and competitive industries like (automobile and jewelry) retailing.

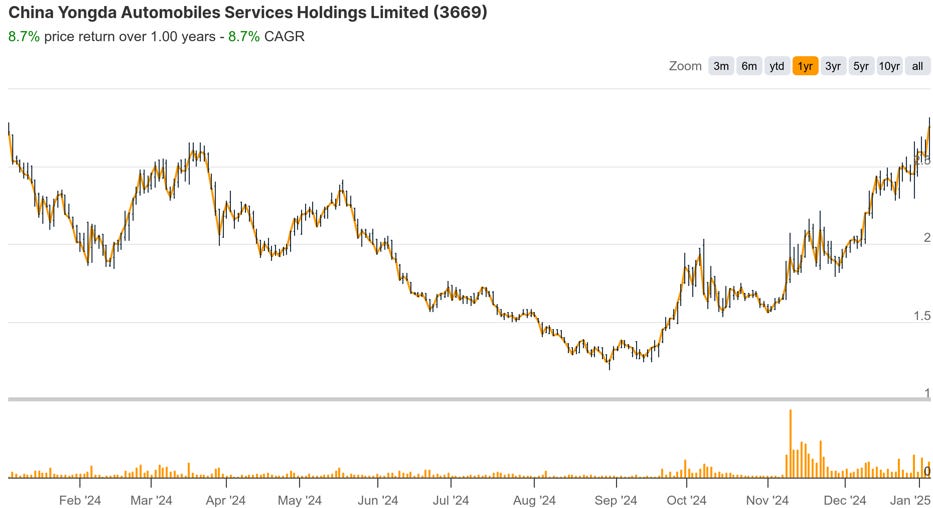

Kuddos to Yongda shareholders for the recent share price recovery!

Jaminvest resources

Some useful links to key resources on Jaminvest.

🏷️ - Financial models/templates/et cetera (f🔐)

🏷️ - Hong Kong (sub-)portfolio posts

🏷️ - Portfolio posts (f🔐)

» » - Stock/Company list, alphabetical lists of many of the stocks mentioned

🏷️ - Tutorials including Excel sheets

Disclaimer

This is neither a recommendation to purchase or sell any of the shares, securities or other instruments mentioned in this document or referred to; nor can this presentation be treated as professional advice to buy, sell or take a position in any shares, securities or other instruments. The information contained herein is based on the study and research of and are merely the written opinions and ideas of the author, and is as such strictly for educational purposes and/or for study or research only. This information should not and cannot be construed as or relied on and (for all intents and purposes) does not constitute financial, investment or any other form of advice. Any investment involves the taking of substantial risks, including (but not limited to) complete loss of capital. Every investor has different strategies, risk tolerances and time frames. You are advised to perform your own independent checks, research or study; and you should contact a licensed professional before making any investment decisions. The author makes it unequivocally clear that there are no warranties, express or implies, as to the accuracy, completeness, or results obtained from any statement, information and/or data set forth herein. The author, shall in no event be held liable to any party for any direct, indirect, punitive, special, incidental, or consequential damages arising directly or indirectly from the use of any of this material.

The property management firm First Service Holdings (2107) offers an attractive dividend yield of approximately 11%.

Financials are clean. Ibkr doesn’t allow retail to buy it currently.

It seems that the investment manager GMO is rather sceptical related to China. They write:

"Chinese stock valuations appear mildly attractive versus their history and are the cheapest major market today. However, the most meaningful influence on their poor returns has been deteriorating fundamentals and significant shareholder dilution, not falling valuations. Weakening return on capital and quality metrics, along with significant geopolitical and regulatory risks, make us cautious on China. We consider emerging markets outside of China to be a better risk/reward trade-off."

As part of a portfolio, however, Chinese stocks make sense in my opinion.

https://www.gmo.com/europe/research-library/bargain-value-trap-or-something-in-between_gmoquarterlyletter/