HK 第15部分; The Experts

For HK 第15部分, 15 experts provide their insights on investing in China/HK

On January 12th, 2024, I introduced two hands full of Hong Kong stocks of mostly profitable businesses trading below their combined net cash and financial assets value (FAV). Since then, I have been documenting my quest to find the best HK “Dollars trading for Pennies”.

The timing of that HK 第部分 series was most fortunate. “Het geluk is met de dommen” as the Dutch say (Luck is with the Dum). Stock sentiment in HK has taken a big step for the better. Time of course will tell whether it lasts or is just a temporary bounce. Imo, part of the reversal in sentiment is thanks to a new push by the Chinese authorities to improve the investor climate, mirroring similar initiatives seen earlier in Japan. This, along with absurd-cheap valuations, and (potentially) improving macro conditions post-covid, could provide a very attractive backdrop for stock returns…

…An opportune moment to learn more about HK stocks! For that purpose, I introduce you to the China/HK investors who have been most helpful in my learning journey. Each of them, provided a brief free-format contribution below.

Thanks so much, guys!!

Please use the links to their respective substack/twitter/website to follow them more closely.

The Hong Kong Experts

In alphabetical order;

on the post-mortem: a tool to improve as an investor, and LH Group

on his out-of-HK strategy, and WH Group, ESR and Samsonite ao’s

/

on King Fookshares his 5 rules for successful investing in Chinese companies

on rising investor interest and Quercus Fund’s positions in Tianjin Development, China Sanjiang Fine Chemicals, and First Pacific

on Fu Shou Yuan

/ Asian Century Stocks on the latest HK stock market rally, and Best Mart 360

on his investment strategy and First Pacific

/ Weighted Capital on the shareholder activist case at China Merchant China Direct Investment

on investment strategy

on China Dongxiang and First Service

with an extended preview of his debut on substack, about Left Field Printing

; Hong Kong remains well-positioned as China's gateway to emerging markets

Undervalued-Shares.com on the attractions of Hong Kong (stocks) and how to play the opportunity

Let’s get to it! The contributions of the experts;

Active Alpha Research

Substack:

Twitter: @AlphaExponent

The post-mortem: a tool to improve as an investor

If we can continually identify and remove sources of underperformance, we outperform. In the past month, apart from names we missed due to lack of conviction, the chief sources of underperformance in our portfolio were:

Hedge. Maintaining a hedge and reasonable diversification.

Market-timing. Trying to time the market, and reducing our PDD holding before its move up, leading to a good chunk of the portfolio being in cash.

Security selection. Being mistaken in the thesis for LH Group.

The first factor is not a bug but a feature. The second factor is more culpable, and arose in part due to the desire to protect our earlier gains, though the last factor is the most egregious. The full analysis of the LH Group, a HK restaurant operator, is available here, but the core thesis is simple:

Continued rebounding tourism from PRC (2023 visitor count only recovered to a little over 50% of pre-pandemic levels).

Extra earnings thanks to dining vouchers distributed to PRC tourists.

Low rent (a major cost for HK restaurants) going forward, due to subdued post-pandemic real estate market in HK.

So where did we go wrong? We unintentionally gained exposure to Fed interest rate cuts, or rather, the lack thereof:

The HK dollar is pegged to the US dollar, meaning that the HKMA must keep rates in lockstep with the Fed.

Meanwhile, Japan has maintained low rates both due to its debt burden (otherwise interest payments would be very high), and attempt at stimulating economic activity.

This resulted a much stronger US dollar, and therefore HK dollar, versus the yen (caused by traders doing the old carry trade, borrowing yen and buying dollars to gain from the spread in interest rates).

Thanks to the strong HK dollar vs the weak yen, many of the more affluent Hong Kongers are flying directly to Japan to get their fix of Japanese fine dining.

This resulted in high-end Japanese restaurants discounting, in turn taking patrons away from the likes of the mid-end Gyukaku, LH’s main income stream.

The HK dollar is also strong versus the Chinese Yuan, resulting in significant cross-border tourism, the other way. Lots of Hong Kongers are crossing the border to Shenzhen on the weekends to buy cheaper groceries and dine in the restaurants there.

Meanwhile, dining vouchers notwithstanding, PRC tourists have been favoring cheaper restaurants in HK. For more expensive restaurants, they preferred those not available in mainland China.

Unfortunately, a couple of Gyukakus also set up shop in Shenzhen right before the pandemic (LH Group only operates those in HK).

This meant that the HK Gyukakus had to discount to remain competitive. Since the chain was LH’s Group’s main workhorse, this hit their earnings.

To exacerbate the issue, because of the unexpectedly robust tourist numbers (which we ironically anticipated correctly as the first leg of the thesis), and the stimulus by the HK government (nonresidents previously paid 30% tax on buying property, but this was cut to around 4.25%), rent has also increased more than expected.

Alas, this anti-trifecta only became evident in hindsight, after transpiring events did not match our expectations, and further research to understand why our thesis did not play out (at least in the short term; LH Group is still a strongly managed business relative to competition).

We draw two key conclusions from this sequence of unfortunate events, for any investors interested in the HK market, and China more broadly:

Think macro. Look for unintended macro exposures, especially to the Fed and forex – the HK dollar peg to the US dollar means much of the risk carries over directly. Meanwhile, changes in both PRC and HK policies can also have major impact.

Analyze holistically. Identify and analyze (insomuch as possible) related PRC trends and businesses; even for those that primarily cater to HK patrons, the PRC environment is critical.

Alex Feng

Substack:

Twitter: @SnowsofNebraska

The out-of-HK strategy

Probably I’m less favorable towards HK-listed equities than most of this orchestra. The main reason is as a native Chinese, I’ve never been more disappointed to this country than ever. And if history rhymes, we are only seeing the beginning of the end. I can talk for hours about that topic (if you are fond of scary stories, just come to me), but rather it’s more helpful to discuss HK stocks that can make money here. It’s full of bargains and the market is very depressed, though less depressed these recent weeks. However, HK never lacks bargains. When I started my HK analyst job 10 years ago, my boss told the LPs that HK was the third cheapest market in the world. Fast forward to today, I don’t know if it’s THE cheapest or the second. And it’s been one of the top seeds forever.

As my assumptions for the big picture is very, very bad, I don’t expect it to exit the top spots any time soon. Though I could be wrong, at a wide margin. FYI, I cleared my HK portfolio at the wake of COVID re-opening in Oct 2022. I missed the heroic rebound after, but my forecasts of the economy in general have turned out to be true. So I don’t regret much. Even though the economy can go a lot worse, there could be waves of rebounds like these weeks at any time. I’ve heard about the outperformance of Iran and Russia stocks in the 2010s. Gee, I’d still rather stay away from them even if I had a time machine! But I’d give my best blessings to the brave hearts. And I’m sure the rest of the orchestra have a lot of brilliant ideas.

Where I’d prefer to fish is only a subset of the pond, consisting of those suckers who should have not been here but mistakenly are. Last year JS Global (1691 HK) bailed me out through its spinoff of SharkNinja to the US. There are some other candidates could replicate that story. Here’s the list:

» WH Group

WH Group (288 HK): the owner of China’s No.1 protein product brand Shuanghui as well as its US counterparty Smithfield. The company expressed the thoughts to spinoff Smithfield to US, too. But no concrete plans yet.It seems the owner is waiting for a better cycle. Could take a long time. My general experience is a spinoff would take around a year after the decision is made. No hurries IMO.

» L’Occitane

L’Occitane (973 HK): it’s already played out. The privatization is another perfect example how an alien company can create value by getting out of HK.

» Prada

Prada (1913 HK): looks not that undervalued. But could be someday. Better take an eye on it. The same applies to Techtronic (669 HK).

» ESR

ESR (1821 HK): a logistics and IT-infrastructure asset manager. 80% of the assets are non-China. A privatization offer from some of its PE owners has been received and the Company is evaluating it now, yet not much details are disclosed. The stock bounced back by 50% in the recent month but is still at 2/3 of its IPO price in 2019. US comps such as KKR, Brookfield are traded at very lucrative multiples. ESR has tried many ways to extract value such as assets sales and share repurchases. But those actions didn’t work very well. I’m very confused why the market keeps shorting it even after the offer, at 30%+ a day. But be mindful the business and financial statements are complicated and privatization in HK is not easy.

» Samsonite

Samsonite (1910 HK): currently my largest holding. 11-12x fwd PE vs 25x in the most of 2010s. The business restructurings during COVID is successful but HK market doesn’t care. Cutting down growth guidance from LDD to HSD in Q1 conference plus the very indifferent expression on secondary listing process caused a huge hit on the stock price. Same as ESR, strong short selling pressure. IMO it’s a no brainer for the Company to list in the US and get a 20x PE. The Board should move more quickly. The best comp I think is Columbia. They both serve as leading global brands in a consumer durable category. The consumption of Columbia’s category is more frequent but Samsonite faces less competitions. Columbia’s business is declining (though the consensus is a MSD growth in next few years) but still gets a 20x PE. So I think Samsonite deserves it too. Quite straightforward. Again hopefully the Company can move faster on the listing. IR said consultants have been hired and they are evaluating different listing plans.

Hope those ideas are entertaining. I’d like to express my gratitude for JAM for creating such a wonderful platform.

Alvin Chow

Substack:

/Twitter: @chowyonghan

Gold prices are on a tear, and one reason is that central banks, including China, have been buying gold. China has sold dollar bonds and bought more gold. With a U.S. rate cut on the horizon, the weakening USD would further support high gold prices.

One way to play this trend is to buy jewelers that have gold inventories yet to be cashed in at high prices. High gold prices normally drive more demand, not less, as people fear missing out.

» King Fook

King Fook (SEHK:280) is one such jeweler. A substantial portion of its assets—totaling HK$877.575 million—comprises inventories, primarily jewelry and gold, along with cash and fixed deposits. These assets account for about 90% of its total assets, while total liabilities amount to only HK$251.565 million. This results in a net cash/gold value of HK$626.01 million.

With a total of 909,308,465 outstanding shares, the net cash/gold per share value for King Fook stands at HK$0.688. Given the current share price of HK$0.41, the stock appears to be trading at a 40% discount before factoring in higher gold prices.

The undervaluation likely stems from its lack of prominence compared to jewelers like Chow Tai Fook and Luk Fook. However, if gold prices maintain their bullish trend, a value unlocking event could result in a significant surge in revenue, earnings, and dividends, attracting investor attention.

Dabao

Substack:

Twitter: @DaBao_

1. Choose industries that you already familiar with to cut down learning curve

2. Expect things don't work and expect the worst scenario

3. If choosing between an average company with good shareholder return and a good company with average shareholder return, always choose the former

4. Pick companies based in Pearl River delta or Yangtze River Delta

Why companies from this region? They are more developed, better rule of law, more entrepreneurial spirit, huge diaspora overseas, Yangtze River is especially usually for mass scale low cost transportation, they both have good ports...etc

Recommended learning;

https://en.wikipedia.org/wiki/Yangtze_Delta

5. Aim for a 10% total return, above that your expectation is too high

Diego Milano

Website: www.quercusfund.com

Substack:

Twitter: @diegobmilano

It seems there is a growing interest by the investment community in HK-listed stocks, after being ignored for years.

In the latest disclosed 13-Fs, a number of well-regarded hedge funds disclosed recent buys of Chinese stocks and ETFs listed in the US (SEC only requires them to disclose US listed securities).

While one can always rationalize justifications for some discount, the valuation gap can become just too extreme - more extreme, in fact, than in frontier markets, or countries suffering from hyperinflation.

Even after the appreciation of 20% of HK's main index over the the past month, there are still plenty of bargains in this market.

Some of the largest positions of Quercus Fund continue to be:

» Tianjin Development 🏷️

$882 Tianjin Dev: an investment holding SOE, trades at half its net cash, at 3x P/E. About half its profits comes from a minority stake in Otis China. Elevators are great businesses, usually oligopolistic, with maintenance revenues being highly resilient. Yet in China, new equipment is still an important part of the profits. Since its spin-off in 2020, Otis Worldwide has been focusing on maintenance service in China. The real estate crisis has taken a toll on Otis China's revenues: down by more than 20% in the past 2 years. However, profits increased by 10% in the same period. This dichotomy eclipses the development being taken in its service business. Once China's real estate sector stabilizes, the growth of the service segment should become clear. Additionally, Tianjin Dev has stakes in two listed companies that are worth more than its market cap.

» Sanjiang Chemicals

$2198 Sanjiang Chemicals: globally, the chemical industry has been through the toughest cycle of the past few decades. Sanjiang embarked on a huge capacity expansion, at a total cost of more than 5x its current market cap, right before Covid. The new facilities started running last year. During the past two quarters, peers have stated that things started slowly moving positively, and in 12 to 18 months we could move back to mid cycle levels. How much money the expanded Sanjiang will be able to make with mid cycle margins? We don't have a historical basis, since the plant is new, but given the size of the investment, it seems compelling. The controlling family agrees: they bought more than 40% of the total volume traded in April, even after the stock was up 70% in March.

» First Pacific 🏷️

$142 First Pacific: while listed in HK, it has no assets in China. It is a Southeast Asian conglomerate, whose main assets are controlling stakes in Indofood (food in Indonesia and Africa) and Metro Pacific (infrastructure in the Philippines), and PLDT (telco in the Philippines). Indofood's noodles is a world-class business: adjusting for goodwill, returns on capital are north of 50%, with margins on par to Unilever and Procter and Gamble's. Its main brand is the 7th most consumed in the world. Geographically, its positioning is enviable, with positive demographics and infra needs in SE Asia, in addition to noodle investments in Africa. All that for less than 3x P/E.

Some of these names went up really fast in the last couple of months. Will the trend continue? I have no idea. Are they still extremely undervalued? I believe so.

Investing in China

Substack:

Twitter: @investingichina

When

asked me to write a short pitch about an investment idea, I really loved the idea because I don't like deep dives. I believe one has to figure out the two or three key variables that will decide if an investment is successful or not.Fu Shou Yuan 🏷️

The stock I'm going to talk about is Fushou Yuan International Group $1448.HK (Jam_invest talked about them before too), which is the largest Chinese funeral home. Their operations consist mainly of three segments:

the sale of land for burial

burial services including ceremonies and increasingly technological items and virtual mourning

the sale of cremation machines and others (which is not relevant for this thesis).

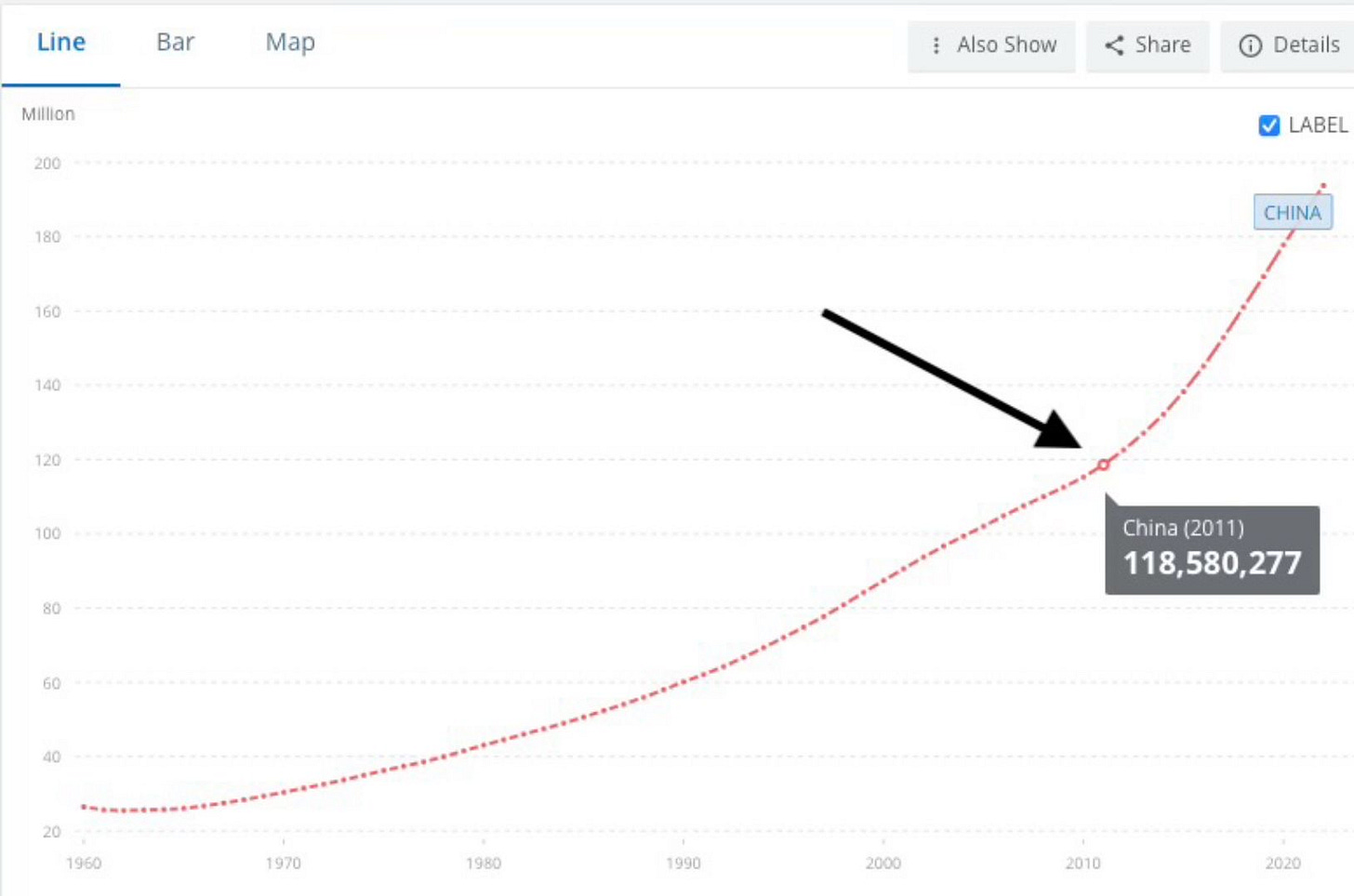

Essentially, my whole investment thesis for this stock is captured in this picture, which shows the population in China aged above 65 years according to the World Bank. The important part is the fold that occurs around 2011. Since 2011, the number of people aged 65 and above has been increasing at a faster rate, and currently, there are about 200 million people in this age group. Combined with the current life expectancy of 78 years, I estimate that the number of deaths will increase much faster, about 4% year over year, in the next 20 years as the people aged 65 in 2011 are essentially turning 78 now.

Fushouyuan, as the biggest player in the field, should at least proportionally benefit from this development. Essentially, we have a very predictable 4% tailwind over the next 20 years. So far, this is nothing special, but what is interesting is that the market completely ignores it. It seems people have forgotten Ben Franklin's saying that the only certain things are death and taxes.

When you do a very conservative reverse discounted cash flow analysis, you see that currently the market expects 0% growth. I'm betting against that, saying that a 4% growth should be the base case, which alone would imply an upside of more than 30%.

In the past years, Fushouyuan has been growing free cash flow by around 15% year over year, mainly due to organic growth and acquiring and improving poorly run mom-and-pop funeral homes. So, it is not unreasonable to expect additional growth on top of the 4%, especially now as the increasing use of technology gives them a competitive advantage over smaller players that they did not have in the past. That should provide a bigger upside than just the mere 30% mentioned above.

Another way to triangulate the value is by noting that before 2021, they were trading on average at about EV/FCF = 18, and currently, they are at 8, with, in my opinion, equally good growth prospects. I think this is mainly sentiment, as they have been falling in lockstep with the Hang Seng since April 2021, independently of their business development.

I also visited their facilities and had my wife's assistant call all the funeral homes in Shanghai (which made her question my sanity). They pay dividends and so on, but all that is not too relevant.

It's just about basic statistics and the fold in the graph.

Michael Fritzell

Substack:

/ Asian Century StocksTwitter: @MikeFritzell

Jam Invest

Congratulations on your timing with regards to Hong Kong stocks. A rally, at last! I can feel that investors are starting to pay attention to Hong Kong again. We’ve had a long and vicious bear market. First, with the 2019 anti-government protests, then the 2020 National Security Law and finally the 2021 crackdowns on China’s tech platforms, tuition companies and private property developers. But today, it feels like sentiment has gone too far in the other direction. I mean, how often do you find solid companies trading at P/E ratios way below their dividend yields? I think the market probably bottomed in mid-January this year and that we’ll see a solid recovery from the most beaten-down names.

Best Mart 360 🏷️

I traveled to Hong Kong a few weeks ago and I came away bullish on leisure food retailer Best Mart 360. You can think of it as a mix between a supermarket and a convenience store. Compared to a full-fledged supermarket, the only thing that’s missing is perishables. But that’s part of Best Mart 360’s approach: they only buy inventory that doesn’t go bad, and they buy their inventory from the gray market. That’s enabled them to keep prices incredibly low. The company’s success can be seen from its industry-leading sales/store and a return on equity of 49%. The store count has grown at an annual 17% rate over the past five years, and earnings per share has compounded at 23% per year. The P/E is 8.2x and my best guess for the dividend yield is somewhere between 6% and 10%. The only question mark with Best Mart is that Chinese state-owned enterprise China Merchants Group has taken a 49% stake in it, and it’s possible that governance will deteriorate. But the two co-founders are still in charge, and I think there’s still significant upside from Best Mart’s current footprint of 170 stores. It has a winning formula. Now it’s just a matter of rolling out new stores and letting the operating leverage work its magic.

Olivier at Emerging Value

Substack:

Twitter: @ReturnsJourney

I am a private investor and I have absolutely no specific local knowledge in Asia. I however did well overall with HK stocks, due to a process that lets probabilities work in my favour: Buy many cheap defensive assets with capital deployment or return.

I believe that HK stocks offer great value at the moment. HK is for people who are patient and not short term minded. If you buy stocks in HK, it’s about the business, not about short term catalysts and market sentiment. It’s not like the US where changing the CEO or reporting structure, or selling a division externalises value quickly.

So what I did in HK is a diversified subset of companies, with mostly non mainland China headquarters due to fraud risks.

I like the companies with access to South East Asia assets. The exceptions are the tech stocks I bought in early 2024 like Alibaba.

First Pacific 🏷️

One of these is First Pacific (142.HK), for which I had a write up long ago. They made ill timed investments in commodities before the 2015 down cycle and lost the confidence of the market. Since then, they recentered in their core investments which are:

The largest Philippines telco with a huge fintech branch.

A Large Infrastructure company in the Philippines

A leading food and noodles conglomerate in Indonesia.

Earnings have grown a lot recently, and the stock had positive returns, but there was no rerating, it’s purely earnings growth and the P/E ratio is still 3.

The management has a bad reputation online due to self dealings maybe in the 2000s or 90s. However, in recent years, they returned a lot of dividends and grew the business by acquisitions at the subsidiary levels, so I have no problems with the management and I think that things evolved positively.

I view it as a defensive long term holding at a P/E of 3.2 and a growing dividend yield of 6%.

Any meaningful change of sentiment about Asia will send most stocks up 100%, or 200% in the case of First Pacific, just to return to previous valuations.

I am no longer searching for stocks in HK, while riding the HK stocks I already have. I remain cautious about my maximum exposure per market, and especially in HK.

If I was a HK resident, I would probably use my local knowledge and regulatory safety to be over 90% in HK stocks.

Ong Wee Hiang

Substack:

/ Weighted CapitalTwitter: @weightedcapital

Firework close for a close end fund:

Going back to the strong bull market. Every bull market comes with some pullback and it is often wise to imbue your portfolio with some “Special Situation”.

A few of my friends and I just had a call with Brian from Argyle Street Management (ASM).

They have laid out an almost water tight case here, at

China Merchant China Direct Investment (CMCDI)

China Merchant China Direct Investment (CMCDI) / $133.hk.

The red box is where ASM started their public campaign.

ASM is dealing with with a SOE which has been underperforming for years!

If we are judging the success of this activist campaign on its share price so far, it should be seen as a great success.

But I do not think that ASM is done here.

As of 13th May 2024, ASM holds a 8% stake in CMCDI. They are majority shareholders now and it will be hard for them to exit unless some corporate action happens.

That means that CMCDI needs to

sell some public investment

do some repurchase of their stock,

even considering a delisting before ASM can exit in an orderly manner.

As for us, we can just ride the coattail of ASM and should probably exit before ASM does? *The flea is just going on a ride on the back of the big black bear*

This is one of the few cases that the risk decreases as the stock price rises.

ASM is showing CMCDI that the activist campaign is working (elevating the share price).

CMCDI has no reason to fight so hard and may want to go with the flow. (they are SOE afterall)

If you pull out the frame further out into max, then the last peak for CMCDI is HKD 20.55 on the 8th May 2015.

Personally, I will not be looking at HKD 20.55 to get out. On average, close end funds operates at a 30% discount.

On a side note, for those who holds on to CMCDI, it is time to drop them an email at info@cmcdi.com.hk to tell them why they should work cordially with ASM for the greater good of the motherland.

Oriental Value

Substack:

Twitter: @OrientalValue

While many inexpensive stocks can be found in Hong Kong, it is essential to distinguish between superficially cheap stocks and genuinely undervalued ones to avoid value traps.

To avoid the pitfalls of being stuck with "deep value" stocks, we focus on companies' ability to return capital to shareholders. This approach provides a more reliable means of achieving respectable returns without relying on major shareholders, management, or the market suddenly recognizing the companies' undervaluation. By understanding a business’s earning potential over time and the management’s approach to capital allocation, we tend to identify companies with higher dividend yields. Consequently, readers may notice that the companies we highlight often offer higher dividend yields but may not necessarily trade at a discount to their net book value.

Paulo Santos

Substack:

Twitter: @ThinkFinance999

SeekingAlpha: Idea Generator

China Dongxiang 🏷️

China Dongxiang ‘s (3818 SEHK) main business isn’t interesting at all. It’s an apparel retailer, whose main asset is the Kappa brand (originally Italian). However, what really sets Dongxiang apart is that it has a huge amount of invested funds, when compared to its market cap.

While at HKD 0.38 Dongxiang has a $285 million market cap, considering its investments and net cash, it actually sits on a $1.29 billion negative EV. Were it to trade to EV 0 (which is unlikely, as it will always trade at some sort of discount, but 30%-40% away from EV 0 would be more typical for an holding) and the stock would have to go up 352%.

Now, around half of Dongxiang’s investments are in (Chinese, but also international) Private Equity. These aren’t easily liquid. But Dongxiang is highly diversified among those investments as well as others. While China / Hong Kong markets were doing badly, these investments punished its net profits. But now that China / Hong Kong markets arguably stopped doing badly, Dongxiang’s investments have the possibility of acting as a leveraged and at the same time deeply, ridiculously discounted bet on such assets. Moreover, Dongxiang has, in the past, when its net profits did well, shown the willingness to pay out large dividends.

Dongxiang typically tries to pay a dividend even during lean years. Currently it sits at a 4.8% gross dividend yield.

Dongxiang is thus more of an asset play than the conventional “low valuation multiple” or “cash flow” plays. This even though its (less relevant) apparel business did well for 3 out of the last 4 quarters on a same-store basis.

The main risk I see is, naturally, from Dongxiang’s investments in Private Equity, which can often be mispriced and isn’t liquid. But the overall discount is simply too large to ignore, especially in front of a potential Chinese rally which would simultaneously help (liquify and push higher) even the PE assets.

: Paulo sent in two examples of the deep value which can be found among Hong Kong small caps. Please find the other example, First Service (2107 SEHK) as an encore in Footnote 1.Praya Value

Substack:

Twitter: @ValuePraya

Left Field Printing

Left Field Printing (HKEX:1540) is a book printer led by proven capital allocators, with an unappreciated strategically advantaged position. The company is a subsidiary of Lion Rock Group (HKEX:1127), one of the largest book printers in the world.

Investment Thesis

The immediate reaction of everyone when they hear ‘asset-heavy book printer in Australia’ is understandably to run for the hills. Industrial manufacturing in a dying industry, with 0 moat against foreign imports from companies like Lion Rock. However, there are a few underappreciated aspects that make the company interesting:

Cost:

As the VIC writeup mentions, Lion Rock generally makes ‘evergreen’ show piece books, with the benefit that they are generally more insulated from ebooks. However there is another facet that was not discussed. These glossy, colour books (4c printing in the industry) are more expensive to produce. As a result, the proportion of the cost that shipping it across the world takes up is smaller, which makes Chinese printers like 1010 more competitive. For ‘1c’ (black and white) printing, the cost is lower, which makes domestic printers -whether in Australia, the UK or the US more capable of competing. Australia’s isolated geographic position makes this effect even more pronounced. The landed cost is about equal between offshore and onshore.

Speed:

Within 1c printing, requirements for faster turnarounds means Left Field is stronger in fiction compared to manuals, journals and catalogues etc.

In recent years, the industry has been shifting from offset printing, where you manufacture a unique plate for each book, coat it in ink and press it onto paper, to digital printing, which is more similar to consumer-type printers. The upfront fixed investment for digital is much lower, driving a major change in publisher behaviour. With offset printing you’d make a large print order, on the scale of thousands/tens of thousands of copies to amortise the upfront cost of the plates. With digital, you can order much smaller quantities, lowering inventory risk and improving working capital efficiency, even though currently digital printing is still marginally more expensive than scaled offset per copy. The move to an asset-light inventory strategy from publishers means a rapid turnaround time is important in case of unexpected demand. Left Field can deliver on a scale of weeks, while it’d be months if you were to import.Combined, this has resulted in a position where Lion Rock, through 1010, imports coffee table books into Australia, while Left Field, through its subsidiaries Opus; McPherson; and Griffin manufacture fiction books in Australia.

Acquisitions:

Historically, negotiating power has been in the hands of publishers. Shrinking demand has resulted in structural oversupply and vicious price wars between printers both in Australia and China. Every printer that has been acquired into Left Field over the past decade+ was unprofitable, before being turned around by CK and team. Today, Left Field prints for Penguin Random House; Macmillan; Hachette and practically all other small/medium publishers. The remaining 10% of the market, HarperCollins, is printed by IVE(ASX:IGL), an integrated marketing firm with a strategy of cross-selling legacy printed media customers on digital marketing. Fiction printing is non-strategic and accounts for <5% of revenue. Left Field management seems bullish on acquiring HarperCollins when that contract expires soon, which I tend to agree with. After all this consolidation, for the first time since ebooks appeared, the pricing power lies with the printers (well, printer).

Left Field is absolutely aware of their newfound market position. Immediately after the Griffin Press merger, several smaller publishers complained that prices had been increased dramatically. I further believe that Left Field’s pricing power is not yet reflected in their financials, as they are still streamlining Griffin’s operations after acquisition. Lion rock’s printing turnarounds usually takes 2-4 years to complete, suggesting numbers should begin inflecting this year, through 2026.

Valuation

An attractive aspect of CK Lau’s companies is that they deliver shareholder value for minorities. Aside from large dividends, and his TSR record, they recently made a tender offer for 25% of the Quarto Group (LSE: QRT), offering a 25% premium, despite not technically needing to. This gives me confidence in underwriting a generous payout for Left Field. Currently there is a dividend payout ratio of ~60%, yielding 8.3%. I expect the payout ratio to be maintained or increased, as there is no more M&A on the horizon. It is trading at a 5.8x trailing PE, or 4.5x my forward estimate. Modeling an increase in operating margins to 9% from a streamlined Griffin and better pricing power; and an exit multiple of 6x, there is an IRR of 17%.

: Subscribe to to receive the full write-up on Left Field Printing. It is his maiden post on substack!Pyramids and Pagodas

Substack:

Twitter: @Decipherintl

Hong Kong remains well-positioned as China's gateway to emerging markets

Pyramids and Pagodas has long focused on contextualizing emerging market opportunities through a geopolitical and thematic lens. We frequently discuss Hong Kong (HK)-listed companies investing in markets benefiting from China's Belt and Road Initiative. Companies which we have covered over the past year, such as Great Wall Motor (2333.HK) +61%, payment terminal manufacturer PAX Global (0327.HK) +1% and appliance maker TCL Electronics (1070.HK) +62%, have ramped up sales in emerging markets. In these markets, consumer bases are rapidly expanding and competition from big western players is limited due to geopolitical concerns or inability to compete on margin.

While HK’s financial hub status is challenged by tensions with the west, it serves as an important bridge for Chinese capital, trade, and currency flowing into the developing world. Having experienced its own issues with western investors, the HK government has stepped up efforts to attract capital from elsewhere, particularly the Middle East. While HK banks remain wary of secondary sanctions, we are seeing a growing tide of western-domiciled Russian businesses looking to shift operational presence to Asia’s finance hub.

China’s surging trade with Russia and the Middle East is increasingly settled in CNY, which is in the early stages of becoming a reserve asset. From diversifying reserves like gold to replicating Iran's model of co-developing trade independent of sanctions, strategic partners show increasing currency cooperation bypassing SWIFT constraints entirely. When assessing USD dominance, the oft-cited SWIFT data cannot be looked at in isolation, as China’s China International Payments System (CIPS) and Russia’s System for Transfer of Financial Messages (SPFS) systems are increasingly used. As of March 2024, CIPS saw a 40% yoy increase in transactions to CNY 35 trillion (USD 4.8 trillion), with 1,511 participants across 114 countries and regions. This figure is up from 1,162 participants in 117 countries in March 2021. This rapid global expansion, particularly in emerging markets, highlights the growing adoption of the CNY-based system. The role of HK as the main CNY clearing hub is a key benefit, facilitating this shift away from the dollar.

Saudi companies and family offices, also wary of western backlash over the Kingdom’s dubious rights record, are increasingly looking to Asia amid surging CNY-denominated energy trade. Aramco (2222.SE) is betting big on refining and petrochemicals in China, with the likes of PetroChina (0857.HK) and Sinopec (0386.HK) doing the same in the Middle East. Saudi companies have pursued secondary listings on the HK Exchange via the newly launched Saudi equities ETF (2830.HK), returning +6% so far this year. This affords exposure to Saudi growth, underpinned by China's currency swap agreements and cross-border settlements denominated in CNY.

We continue to hold that HK’s strategic position as a financial hub, coupled with China's expanding global influence and efforts to internationalize the CNY, presents undervalued investment opportunities. Investors can capitalize by allocating to HK-listed Chinese companies venturing into emerging markets, or more broadly into gold and gold miners for a long-term de-dollarization play.

Undervalued-Shares.com

Website: Undervalued-Shares.com

Twitter: @uv_shares

I was one of those investors who hadn't looked at the Hong Kong market in years, but who recently got attracted by the low valuations. Visiting the former Crown colony and attending meetings with public companies in late April 2024, I heard that Hong Kong recently had a record number of investors visiting. Galaxy Entertainment, for instance, usually holds 500 investor presentations a year, but had already done 300 in 2024 before April was over.

Notably, it used to be growth investors who came to Hong Kong, but now it's value investors!

My own website, www.undervalued-shares.com, and that of my collaborator, Michael Fritzell of Asian Century Stocks, includes a report on companies we visited.

Here are three general observations that I would really like to drive home with investors who are curious about Hong Kong.

Scope of market: it'd be easy to think that only a few companies are listed in Hong Kong, given that it's a jurisdiction with just 7m people. However, the Hong Kong exchange comprises 2,000 shares. These break down into different categories of companies and also different share categories, and many of these companies will be Chinese rather than Hong Kong. Still, this market has a lot more variety than I expected – which means there are surprising finds to be made!

Lack of transparency: I love a market that isn't overly transparent, because it gives you a chance to gain an edge over other investors. In that sense, Hong Kong reminded me of Germany in the 1990s. It's a paradise for bargain hunters and those who are willing to put in legwork to meet companies and founders, or to do other forms of on-the-ground research.

Growth prospects: the Western media like to say the Hong Kong story is over. I went with an open mind and – after spending two weeks on the ground and meeting many people from very different backgrounds and political persuasions – got a different impression. The era of Western expats having an easy life in Hong Kong may be over, but the city state is now switching to a different era. Hong Kong is a highly attractive place to move to, and it only has 7m people vs 1.3bn people in China. It's also one of these "forever cities", i.e. truly global cities that constantly reinvent themselves. I struggle to imagine any other scenario than Hong Kong being successful in the long run, and largely driven by an inevitable new influx of residents.

With that in mind, I'd say buying a broad selection of Hong Kong stocks at single digit p/e ratios and often double-digit dividend yields is likely to be a winning proposition if you can afford to hold it for the next 3-5 years.

: Once again, a big thank you to the experts for the contribution and the insights! It is a privilege and an honor to post your work!Please do show them your appreciation!!

Footnotes

Paulo Santos

First Service 🏷️

2107.SEHK

This is a property manager now doing around $170 million per year in revenues. Ironically, it shares the name with FirstService Corporation (FSV), a NYSE-listed stock which trades at premium valuation multiples due to property management being seen as a high moat business. It’s a business where, after you capture the customer, the customer is unlikely to change providers (or try to reduce pricing) unless the company blunders in the services it provides.

First Service is growing well. For 2023, it posted 7.9% yoy revenue growth, but this is clouded by the fact that First Service greatly reduced a home automation business where collections were very slow. This effect is lapped in H1 2024, so this alone would already be enough to show accelerated growth. Its main segment, property management proper, grew 13.4% yoy in 2023. First Service also grew net profits by 38.2% yoy.

Lapping the home automation business decline isn’t the only factor telling us First Service’s growth is set to accelerate. Another factor is contracted GFA (Gross Floor Area) and managed GFA growth. There grew by 9.6% and 22.3% yoy, respectively. A lot of this growth came in H2 2023, so it will help revenues accelerate further in H1 2024.

First Service also has the distinction of having outgrown the market consistently over several years. This can be seen in its progression through the ranks of China’s 100 top property managers (2016: 51st largest; 2019: 35th; 2023: 19th).

So far, we can see First Service is a stable to growing business with prospects of continued growth in an industry that is typically seen as “moaty”. Where things get even more interesting is in how the market is valuing First Service. Between net cash and investments (including some investment properties gotten as settlement for receivables), First Services trades at a negative $82 million EV, whereas its market cap is $43 million. To even reach EV 0, First Service’s stock would have to go up 71%.

Moreover, at HKD 0.34 it also trades at 4.8x Price/Earnings (assuming 15% net profit growth in 2024), 3.0x Price/(EBITDA-capex) (a proxy for Price/FCF) and carries a 12.4% dividend yield (based on 2023 net profit). It actually increased its dividend by 40% in 2023.

All of this doesn’t come fully without risk, though. A part of the business First Service gets is from related entities, and these related entities have created receivables a good chunk of which has had to be provisioned. These provisions are already on the reported numbers and valuation multiples, though. Arguably, there will be more such charges in the future – though margins stand to be higher still once things normalize. First Service has abandoned 2 businesses which tended to generate long-lived receivables: real estate sales support and now home automation systems. These services were to construction companies, most of which ended up paying late or never. Historically, this has introduced volatility to First Service’s revenues and especially profits – volatility which, when we look only at property management services, didn’t really exist.

Another less relevant risk, is that with real estate starts and now completions falling substantially in China, fewer greenfield opportunities will be available to sell property management services into. This means the overall market will present lower growth opportunities and, potentially, more competition for existing customers. That said, it’s very hard to displace a (good) property management company – even discounts don’t really matter a lot when one considers the risk of the property being mismanaged (cleaning, security, maintenance, etc). Also, the property management fee is only a small component of the overall services provided – meaning, the customer doesn’t stand to gain a lot from replacing the property manager, on his overall bill.

Finally, First Service is concluding a deal to acquire 8% of a larger property management firm (which is outgrowing it). This comes at a cost of 26.4% dilution. First Service's multiples will be rather unchanged whether this acquisition closes or not, given the target's profitability. Both First Service and the seller have a call/put option allowing both to terminate this deal (eliminating the dilution) for 3 years. Terminating this deal would also provide a small benefit to First Service (a sort of termination fee).

A common feature among the stock ideas is (excessive) balance sheet strength. Sanjiang Fine Chemicals $2198.hk is a notable exception to that. What are your thoughts on the balance sheet there, Diego?

Very insightful! Tx!