Hidden gems #3; The new collection arrived

Several hidden gems have started to break out to new multi-year highs. Let's look at two companies who are still cheap, and are becoming fashionable now.

Who is leading the way?

Before introducing the new names. It is educational to have a look at another hidden gem that broke out going a little bit further back in time.

Petrobras

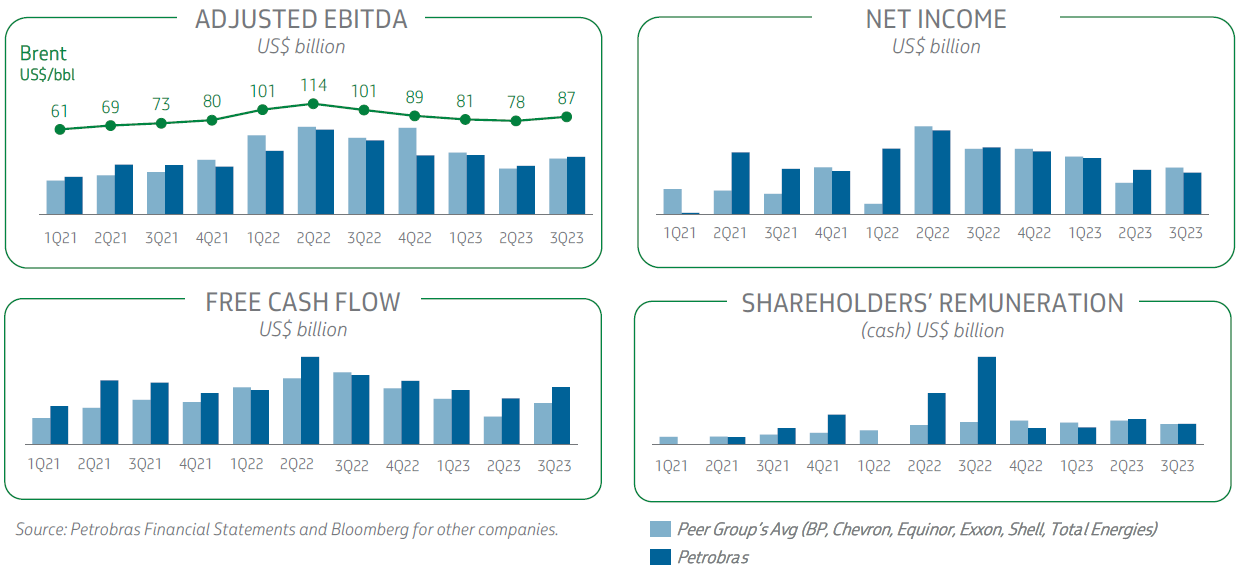

Petrobras $PBR.A (preferred shares) was probably one of the most hated stocks out there. Despite having superior economics to most of the major western oil companies, it was trading at just a fraction of their valuation multiples. Hardly anyone wanted to invest in it because of fear of what a new socialist president would do to it.

Calvin Froedge has been absolutely hitting it out of the park, with his early and constant recommendations on it. Petrobras has done so well, that it cannot really be called a ‘hidden’ gem anymore.

Certainly, oil prices temporarily going above $100 helped a lot in driving investment flows into the energy sector. Nevertheless, I am pretty sure that some of the valuation gap between Petrobras and its western peers would have narrowed, regardless. Strictly the new government policies turning out less bad than feared was enough for a re-rating, towards western peers. Moreover, the constant flow of amazing dividends in itself were already providing an attractive investment return, which helped build out the investor base.

Who’s next?

Clearly, Petrobras has delivered phenomenal returns for shareholders lately. There are various similar examples of companies that have leading economics within their respective industry, and yet, they are trading at H U G E discounts versus their peers in western markets. The shares of companies like Petrobras, Bancolombia $CIB.us, and Bank of Georgia $BGEO.L have already started to re-rate. NB, some discount definitely seems warranted when investing in emerging markets. It just seems that relative valuations for many emerging markets stocks as well as many smaller cap stocks have become too low.